Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

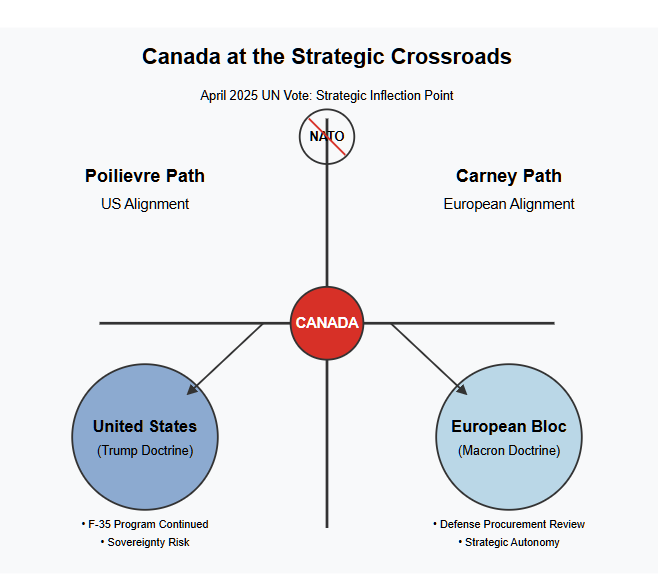

In April 2025, the United States voted against a United Nations resolution condemning Russia’s aggression in Ukraine—marking a historic fracture in Western unity. For the first time since the Cold War, Washington aligned publicly with Russia, Belarus, North Korea, and other authoritarian states on a matter pertaining to Western security integration. This vote, dismissed by some as symbolic, is in fact a foundational signal of a broader strategic realignment that threatens to upend the North Atlantic Treaty Organization (NATO) and redraw Canada’s defense future.

The immediate implications for Canada are profound. The Trudeau government is gone. The federal election is 11 days away. And the two frontrunners—Mark Carney and Pierre Poilievre—represent diametrically opposed visions of Canada’s role in the post-NATO world.

If Carney wins, Canada may suspend or cancel its $19 billion F-35 fighter jet program, joining Portugal and other NATO members in rejecting Lockheed Martin’s strategic software lock-in. A Carney-led government has already signaled a full defense procurement review, open alignment with French President Emmanuel Macron’s European defense initiative, and the repositioning of Canada as a sovereign North Atlantic node—strategically closer to Europe than to an increasingly belligerent and revisionist United States.

If Poilievre wins, Canada will likely double down on its traditional alignment with the U.S.—despite growing evidence that Donald Trump views Canada not as an ally, but as a target. From punitive tariffs to open annexation rhetoric, Trump’s second-term platform is explicitly coercive. Under Poilievre, Canada risks slipping into economic and military dependency, with strategic autonomy sacrificed for ideological proximity.

This brief war-games both outcomes and analyzes the emerging Canada NATO withdrawal scenario, placing it within the broader context of Trump’s NATO realignment, the unraveling of Western air power agreements like the F-35, and Macron’s bold attempt to build a new European defense bloc. The fate of Canada—and by extension, the liberal international order—may hinge on the election in 14 days.

The April 16, 2025 United Nations General Assembly vote marked a decisive break: the United States voted against a resolution that both condemned Russian aggression in Ukraine and reaffirmed cooperation with the Council of Europe. This was not a procedural objection or abstention—it was a full alignment with Russia, Belarus, North Korea, and other anti-democratic regimes. The vote’s diplomatic message is unambiguous: the United States is repositioning itself as a transactional hegemon, not a principled partner.

For Canada, this moment cannot be dismissed. It must be treated as a formal trigger event in national security planning. In the same month, President Trump renewed rhetoric around the annexation of Canada, alongside threats targeting Greenland and the Panama Canal Zone. These are not rhetorical flares; they are doctrinal statements from a post-NATO White House operating under a hemispheric dominance model.0

In parallel, key allied indicators are flashing red:

The cumulative signal is clear: NATO cohesion is collapsing, U.S. strategic behavior is destabilizing, and Canada is being forced into a decision-point it has not faced since the early Cold War.

Perhaps most urgently, the reframing of the United States from partner to emergent threat must now be considered a valid line of analysis. Trump’s documented hostility to Canadian institutions, trade sectors (e.g., dairy, lumber, energy), and now sovereignty itself, has transitioned from policy tension to existential risk vector. This shift must trigger both strategic planning and public narrative repositioning inside Canada.

If Canada is to preserve autonomy in the face of this volatility, it must begin treating Washington as a known variable of risk—not stability.

To assess the likelihood and implications of a potential Canada NATO withdrawal scenario, this brief applies a mixed-method intelligence model incorporating:

This framework is essential for understanding a rapidly shifting environment where assumptions—such as U.S. alliance reliability—are no longer valid.

We evaluated the following hypotheses:

These indicators constitute a strategic shock cluster—a confluence of discrete, high-impact developments collapsing legacy assumptions.

When viewed through adversarial modeling, Canada exhibits the characteristics of a medium-value soft annexation target:

A Trump-led U.S. with Poilievre as a Canadian proxy creates a plausible vector for de facto integration without force—what some strategists might call coercive harmonization. Under Carney, that vector is severed and replaced by continental realignment with Europe.

Analytic Confidence Rating:

On April 16, 2025, the United Nations General Assembly voted on a resolution titled “Cooperation between the United Nations and the Council of Europe.” On paper, the resolution was routine—affirming collaboration between two multilateral institutions and condemning Russia’s ongoing aggression in Ukraine. In practice, however, it was a litmus test for global alignment on democratic norms and geopolitical fault lines.

The United States voted no.

This cannot be overstated: Washington chose to vote against a resolution that explicitly condemned Moscow’s invasion of Ukraine and affirmed institutional cooperation with Europe’s primary multilateral body. The U.S. joined a rogue’s gallery of anti-democratic states—Russia, Belarus, North Korea, Eritrea, Mali, Nicaragua, Niger, and Sudan—in opposing the resolution.

This vote was not procedural. It was ideological.

For Canada, the implications are foundational:

The resolution itself reaffirms many of the values that form the basis of Canada’s foreign policy identity: rule of law, collective security, human rights, and resistance to revanchist territorial aggression. That the U.S. would vote against it—and do so publicly—is not just a departure from past policy. It is a rejection of the normative framework that underpins NATO and the postwar international order.

This vote is not a footnote. It is a foundational fracture.

It marks the moment the United States declared—without saying so directly—that it no longer intends to uphold the rules-based order. For Canada, this changes the equation entirely. As Portugal begins its F-35 cancellation, and Macron prepares for a European defense breakout, this vote must now be treated as a formal point of divergence.

The alliance is broken. The vote made it official.

The Trump administration’s approach to alliances, defense, and diplomacy is not merely unconventional—it is deliberately revisionist. In place of collective security, it offers leverage warfare: a model built on threats, transactional deals, and coercive economic instruments. Nowhere is this more apparent than in the United States’ posture toward its northern neighbor.

Canada, long assumed to be the United States’ most stable ally, is now a primary strategic target in Trump’s hemispheric realignment.

Trump has made clear that traditional alliances like NATO are, in his view, “bad deals” that cost the U.S. more than they return. This is not just posturing. His administration has:

These actions indicate a consistent strategy: abandon formal commitments, then weaponize the resulting uncertainty.

Canada is not just an afterthought in this framework—it is a proving ground.

In 2023, Trump first floated the idea of “reclaiming” Greenland. That same year, he referred to Canada as “energy-rich but weak-willed,” implying it was ripe for strategic takeover. These remarks were dismissed at the time as bombast. They were not.

Since 2024, his team has:

The messaging is clear: Canada is no longer an equal partner. It is a resource base and buffer zone, to be managed—not respected.

Trump’s strategy relies on forcing adversaries and allies alike into bilateral dependencies, where the U.S. sets the terms. The model is:

This logic is now being applied not only to rivals like China, but also to traditional allies like Canada, Germany, and Japan.

Canada under Carney would resist this pressure, potentially at economic cost. Canada under Poilievre could capitulate, aligning with Trump under the guise of continental solidarity—but at the price of sovereignty.

What’s unfolding is not a dispute between allies. It is a slow-motion realignment from partnership to predator-prey logic, with Canada now squarely in the crosshairs.

While the United States drifts deeper into unilateralism under Trump, French President Emmanuel Macron has emerged as the architect of a post-NATO European security doctrine. His efforts are no longer rhetorical. With U.S. credibility collapsing, Macron is now executing a multiphase strategy to replace American-led security guarantees with European-led strategic autonomy—and he is doing so with growing support from core EU and peripheral NATO states.

This is not a theoretical adjustment. It is a reorganization of the Western defense architecture in real time.

Macron’s push for European defense independence dates back to 2017, but it has gained serious traction post-Ukraine invasion and in the wake of Trump’s second presidency. His doctrine is grounded in four pillars:

Macron no longer frames these efforts as “complementary” to NATO. He now defines them as alternatives to a crumbling U.S.-anchored system.

In just the last year:

These are not isolated data points. They represent a systematic attempt to construct a sovereign European military capability, capable of defending democratic interests without U.S. permission.

Canada is central to Macron’s emerging “Atlantic Periphery Doctrine.” With the U.S. unstable and the U.K. outside of the EU, Canada is the most viable English-speaking liberal democracy in the North Atlantic not currently enmeshed in Trump’s orbit. Under a Carney-led government, Canada could:

Macron’s ambition is clear: a realignment of the West, led from Paris and Berlin, no longer subordinated to Washington. And in this vision, Canada is not an afterthought—it is a keystone.

If Mark Carney wins Canada’s federal election in 14 days, it will mark a historic inflection point in Canadian defense and foreign policy. Carney, the former Governor of the Bank of England and Bank of Canada, brings not just economic gravitas but deep transatlantic institutional credibility. He is viewed favorably in Brussels, Berlin, and Paris, and has already signaled his willingness to rethink Canada’s role in a crumbling Western alliance system.

At the heart of his proposed transformation is a bold promise: a comprehensive defense procurement review—a move that directly targets the country’s existing $19 billion F-35 commitment.

The F-35 program is more than a fighter jet contract. It is a strategic leash, and Carney appears prepared to sever it.

Under Carney, Canada is likely to:

Crucially, Carney’s framing positions the U.S. not as the enemy—but as a destabilizing force whose interests now diverge sharply from Canada’s. This is diplomatic realism, not anti-Americanism.

Carney’s messaging would likely emphasize Canadian control, continental autonomy, and pragmatic engagement with Europe. By severing overdependence on the U.S. defense apparatus, Canada under Carney can:

This approach would require strong domestic communication: framing realignment not as betrayal, but as survival.

In this scenario, Canada becomes a founding node in the post-NATO West, bridging European strategic autonomy with North Atlantic infrastructure. It emerges not as a middle power, but as a hinge power—independent, industrially reoriented, and geopolitically repositioned.

The Carney path is bold, but increasingly necessary. It is not a break with the West. It is an attempt to preserve what’s left of it.

If Pierre Poilievre wins the upcoming election, Canada’s trajectory shifts sharply—not toward independence, but toward ideological and strategic subservience to a resurgent Trump-led United States via the Maple MAGA fifth column. While Poilievre has campaigned on themes of sovereignty, cost-cutting, and national pride, his foreign policy instincts—when mapped to Trump’s hemispheric ambitions—point toward a vassal-state framework.

Where Carney would pivot Canada toward Europe, Poilievre would likely tighten integration with the United States—even as Trump openly undermines Canadian sovereignty.

Poilievre’s worldview echoes Trump’s: anti-globalist, nationalist, suspicious of multilateral institutions, and overtly hostile to bureaucratic governance. In practice, this means:

While this may preserve short-term continuity in U.S.-Canada relations, it locks Canada into a volatile, increasingly coercive framework.

Poilievre’s alignment with Trump doesn’t just provoke foreign policy risks—it exacerbates internal Canadian fragmentation:

This is not just political polarization—it’s governance strain. A client-state posture invites internal rejection by populations unwilling to live under de facto U.S. strategic control.

The Poilievre path avoids open conflict with Trump but comes at a steep price:

Under Poilievre, Canada may maintain NATO membership in name, but functionally abandons it in favor of Washington-led bilateralism.

This scenario results in a Canada that is nominally sovereign but strategically hollow. It becomes a satellite—not a partner—of a United States increasingly defined by unpredictability, revanchism, and domestic instability.

Rather than protecting Canadian sovereignty, the Poilievre path may cede it quietly, in the name of economic efficiency and ideological alignment.

In the short term, the U.S. is pleased. In the long term, Canada ceases to exist as an independent actor on the world stage.

Defense procurement has always been more than just hardware—it’s a declaration of strategic identity. Fighter jets, naval vessels, and ISR platforms do not simply reflect operational needs. They embed a country into defense ecosystems, lock in long-term dependency, and shape the political alliances that define war and peace.

Nowhere is this clearer than in Canada’s looming decision on the F-35 fighter jet program, which has become the symbolic centerpiece of the Canada NATO withdrawal scenario.

The F-35 is not just an aircraft. It is an operating system owned by Lockheed Martin, controlled by the U.S. Department of Defense, with encrypted communications, proprietary software, and ongoing dependencies that ensure no F-35 operator can act independently of U.S. strategic control.

Key points:

Choosing the F-35 is not just buying American—it is surrendering digital sovereignty.

Portugal’s decision to exit the F-35 program in early 2025 shattered the illusion that the jet is inevitable. Lisbon cited:

Portugal’s pivot is already influencing other NATO states, and Canada is the next domino.

If Canada suspends or cancels its F-35 procurement, viable alternatives include:

Adopting a European or non-U.S. platform would signal:

What Canada buys now will reverberate for 30+ years. The decision is not just about payload, stealth, or combat range—it’s about choosing between client-state status and sovereign strategy.

If the F-35 contract proceeds unchallenged, Canada will be tethered to an increasingly hostile hegemon. If it is suspended or replaced, Canada sends the clearest signal yet: we are no longer afraid to chart our own path.

Based on current indicators, leadership trajectories, and allied behavior patterns, three primary scenarios emerge. Each has profound implications for Canadian sovereignty, defense posture, and economic stability.

Probability: 60% (If Carney wins election)

Strategic Outcome:

Canada emerges as a hinge power between Europe and North America, preserving sovereignty through plural alliances. Macron’s Atlantic Periphery Doctrine takes form.

Probability: 30% (If Poilievre wins election + Trump consolidates U.S. policy)

Strategic Outcome:

Canada becomes a compliant junior partner in a coercive hemispheric system. Sovereignty erodes. Public trust in national leadership and identity declines.

Probability: 10% (Wildcard Scenario)

Strategic Outcome:

Canada flounders in limbo, unable to fully decouple from the U.S. or commit to a coherent European alternative. The power vacuum strengthens Trump’s hand.

This realignment will not unfold over decades—it is accelerating now. By mid-2026, Canada will either have:

Canada’s next move will be existential, not incremental.

With NATO fracturing, U.S. alignment with authoritarian states increasing, and European defense integration accelerating, Canada must act now to define its strategic identity for the next generation. The status quo is no longer tenable. The illusion of U.S. reliability has been shattered. The question is no longer if realignment is necessary—but how fast and how decisively Canada is willing to move.

Final Directive:

The world is no longer unipolar. Canada’s role is no longer automatic. To remain sovereign, Canada must reforge its alliances, redefine its capabilities, and reclaim its future. Waiting is not strategic patience—it is capitulation.

[…] Trump’s potential NATO withdrawal means Canada can no longer assume U.S. protection. […]