Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

The French National Assembly just set off a geopolitical earthquake. By passing a resolution calling for increased political, economic, and military support to Ukraine—not just from France, but from the entire European bloc, NATO, and allied states—it sent a clear signal: Europe is stepping up as Washington stumbles. The most controversial aspect? A proposal to seize over $400 billion in frozen Russian assets across Europe and redirect them to Ukraine’s war effort. This isn’t just about aid anymore. This is economic warfare.

The timing is no coincidence. The United States, under Donald Trump’s escalating rhetoric, is sliding into full-scale retrenchment, with open threats to abandon NATO commitments and a bizarre, unhinged float about the annexation of Canada. While some dismissed the latter as standard Trumpian bravado, it’s set off alarm bells in Ottawa and beyond. In a world where American unpredictability is the new normal, European leaders are calculating their own survival strategy.

The question is: Can Europe go all-in on Ukraine without U.S. backing? The French resolution suggests they might not have a choice. The EU has long deferred to Washington for security guarantees, but with the U.S. careening toward isolationism, European leaders are eyeing their own military and economic autonomy. The stakes are existential—not just for Ukraine, but for the entire post-WWII Western security order.

This piece dissects what the French resolution means in the grander scheme: a European power shift, a legally murky financial offensive, and the increasingly erratic wildcard that is the United States of America.

The French resolution isn’t just another diplomatic gesture—it’s a battlefield directive for Europe’s future. With Washington’s commitment hanging by a thread, European leaders are being forced to answer a question they’ve dodged for decades: Can the EU function as an independent security power?

For years, European policymakers have relied on the United States to set the agenda on Ukraine. That era is ending. France’s resolution explicitly calls for a unified European stance on long-term support, regardless of U.S. actions. German Chancellor Olaf Scholz and Polish President Andrzej Duda have echoed this, warning that a divided Europe would be easy prey for Russia.

At its core, this shift is about political will. If Europe wants to prevent Ukraine from collapsing under Russian pressure, it must accept a leadership role that Washington is no longer eager to play. The days of waiting for an American president to greenlight aid packages are over.

Beyond weapons, Ukraine needs financial firepower. France’s proposal includes direct economic aid, infrastructure investment, and energy security measures. The EU is already discussing a multi-billion-euro Ukraine Recovery Fund, modeled after the post-COVID economic stimulus. But funding it remains a challenge—hence the push to seize frozen Russian assets.

The big question: Will European banks play along? Major financial institutions, particularly in Germany and the Netherlands, are wary of setting a precedent that could backfire. If Europe moves forward with asset seizures, it’s no longer just a wartime ally—it’s an economic combatant.

Europe’s weapons pipeline is evolving from piecemeal donations to a full-scale arms industrial effort. France is leading the charge, pledging more 155-mm shells and AASM glide bombs. Poland has ramped up its production of Krab self-propelled howitzers, and Germany is expanding its tank refurbishing programs.

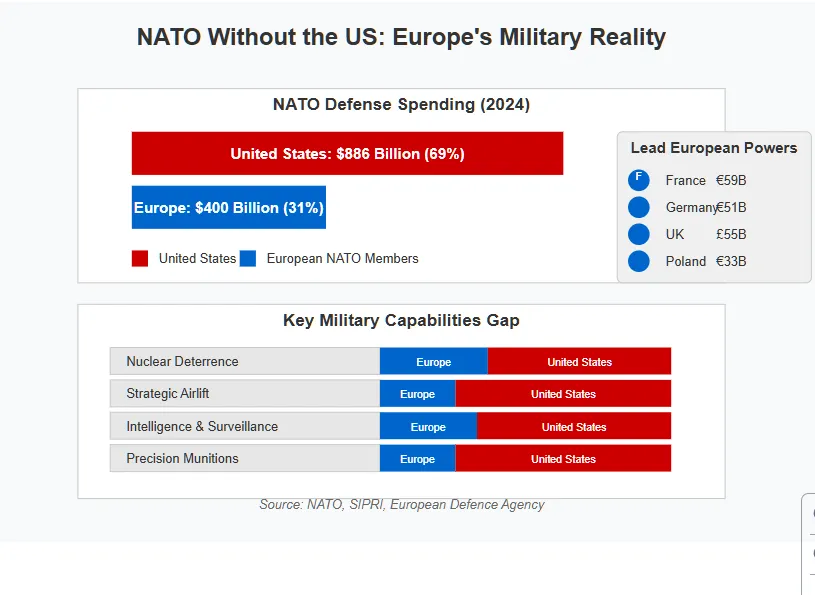

But will this be enough without American arms? That’s where NATO fragmentation gets dangerous. Without U.S. logistics, European arms deliveries will take longer and require greater financial investment. The French resolution signals that leaders understand this and are preparing for it—but whether the continent can sustain long-term rearmament without Washington remains an open question.

The takeaway? Europe is stepping up, but it’s not ready for a world where it fights alone. Yet.

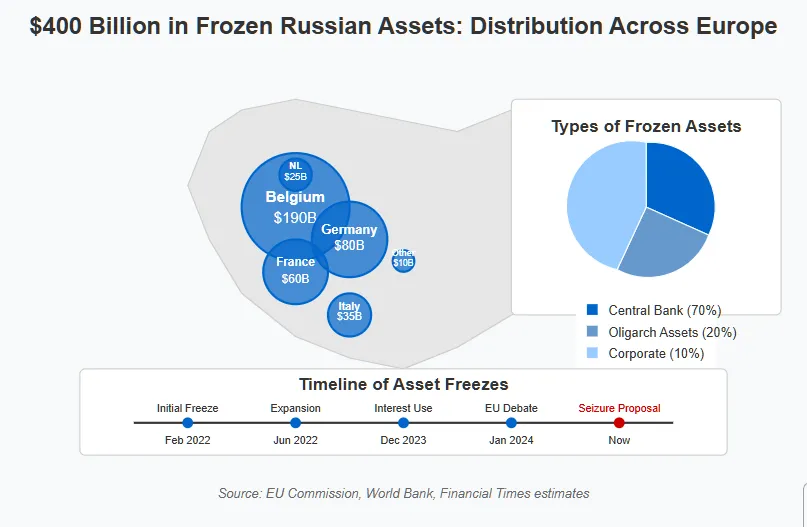

The $400 billion question isn’t just about Ukraine—it’s about rewriting the rules of global finance. The French resolution’s call to confiscate frozen Russian assets across Europe isn’t just unprecedented—it’s an act of economic war. If carried out, this would mark the largest state-sanctioned asset seizure since World War II, shattering the financial assumptions that have governed international banking for decades.

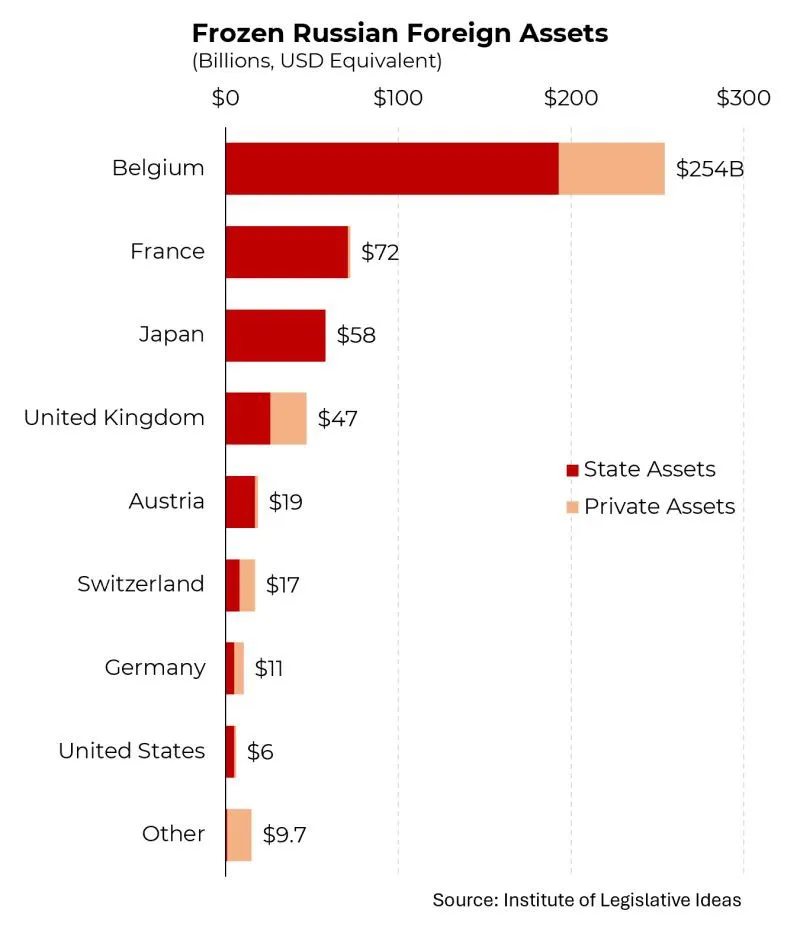

Since the start of the war, Western governments have frozen an estimated $300-$400 billion in Russian central bank reserves and oligarch assets, with the largest amounts held in Belgium, Germany, and France. Originally, these funds were meant to be bargaining chips—potential leverage for future negotiations with Moscow.

But as Ukraine’s financial needs balloon, the EU is now debating whether to stop waiting and start spending. French lawmakers are arguing that these assets should be diverted into direct military aid and reconstruction efforts—a move that would simultaneously fund Ukraine’s war effort and send an unambiguous message to Russia: Your money is gone, and it’s not coming back.

There’s just one problem: No one has done this before at this scale. Confiscating sovereign assets outright (as opposed to freezing them) is legally murky. The EU’s own lawyers can’t agree on whether it’s possible, and critics argue it could shatter trust in European banking institutions.

Opponents warn that this move could trigger unintended consequences, such as:

Despite the legal quagmire, the political pressure is mounting. Ukraine has no time for legal debates—it needs cash, and it needs it now. The question isn’t whether the EU can do this—it’s whether they’re willing to take the risk.

Faced with legal gridlock, European policymakers are considering alternative methods to unlock these funds. Some proposals include:

The biggest risk? Precedent. If Russian assets can be seized today, who’s next? China, Saudi Arabia, or even American firms facing future political disputes? The stakes aren’t just about Ukraine—they’re about the future of global capital.

The EU is playing with fire. The only question is whether they’ll strike the match.

While Europe scrambles to fortify its commitment to Ukraine, the U.S. is moving in the opposite direction. Donald Trump’s increasingly erratic foreign policy pronouncements—ranging from NATO abandonment to outright threats of annexing Canada—have thrown European security planning into chaos. What happens if the U.S. fully retreats from global leadership?

The Trump Doctrine—if it can be called that—is a blend of isolationism, transactional alliances, and scorched-earth rhetoric. His recent comments on NATO, where he suggested he’d “encourage Russia to do whatever the hell they want” to member states not meeting spending requirements, have sent shockwaves through Europe.

It’s not just talk. Trump’s allies in Congress have already slowed down Ukraine aid, and if he returns to office, expect a full-on pivot to retrenchment. His worldview is clear:

This leaves the EU scrambling for contingencies. Can it deter Russian aggression without U.S. firepower?

Trump’s open hostility toward NATO could fracture the alliance beyond repair. The strategic equation is brutal:

Without U.S. leadership, the weight falls on France, Germany, and Poland—three countries with vastly different military doctrines and strategic priorities. Is Europe ready to replace U.S. leadership with its own?

European leaders see the writing on the wall. They’ve ramped up defense spending, with Germany abandoning its post-Cold War pacifism and France pushing for a European military-industrial expansion.

But this goes beyond money. The EU is quietly exploring an independent security alliance, one that could function even if Washington goes rogue. Some options include:

The bottom line? NATO, as we know it, may not survive a second Trump presidency in spite of the existence of multiple flashpoints for war between NATO and Russia in Europe. Europe is finally acting like it understands that. The only question is whether it’s too late.

Just when it seemed Trump’s foreign policy couldn’t get more unhinged, he casually floated the idea of annexing Canada. What started as an offhand remark about Canada’s “natural place” within the U.S. has spiraled into a full-blown diplomatic crisis. While dismissed as typical Trumpian bluster, it raises real questions about America’s strategic trajectory under his leadership.

Trump’s fixation on Canada isn’t new. He’s long viewed Canada as an ungrateful neighbor that benefits from U.S. security guarantees while failing to match military spending. But recent statements have taken a more aggressive tone, with Trump openly discussing:

While mainstream U.S. politicians dismiss these ideas, Trump’s base doesn’t. America’s right-wing media has begun flirting with annexation narratives, particularly regarding Canada’s:

This isn’t just a fringe theory anymore—it’s creeping into the mainstream of American ultra-nationalist discourse.

Officially, Canada’s response has been dismissive. Trudeau’s government issued a brief statement calling the remarks “absurd.” But behind the scenes, Canada’s military planners aren’t laughing. Internal reports suggest:

More critically, Canadian defense spending has quietly jumped. The latest budget sees a 25% increase in military funding, with more emphasis on cyber warfare and Arctic security.

The deeper concern? If the U.S. stops guaranteeing Canadian sovereignty, who does? Canada has no nuclear deterrent, and its military is heavily integrated with U.S. command structures. If Trump’s rhetoric escalates, Canada will need new security arrangements—fast. As it stands, the United States is an existential threat to Canada.

The U.S. threatening a NATO ally isn’t just bizarre—it’s unprecedented. European leaders are watching with growing unease, realizing that if Trump is willing to threaten Canada, what stops him from ignoring NATO Article 5 entirely?

Strategically, this situation has global ramifications:

The bottom line? This isn’t just a diplomatic gaffe—it’s a fundamental signal about how a second Trump presidency could reshape global alliances. Reconciliation between Canada and the US is likely impossible.

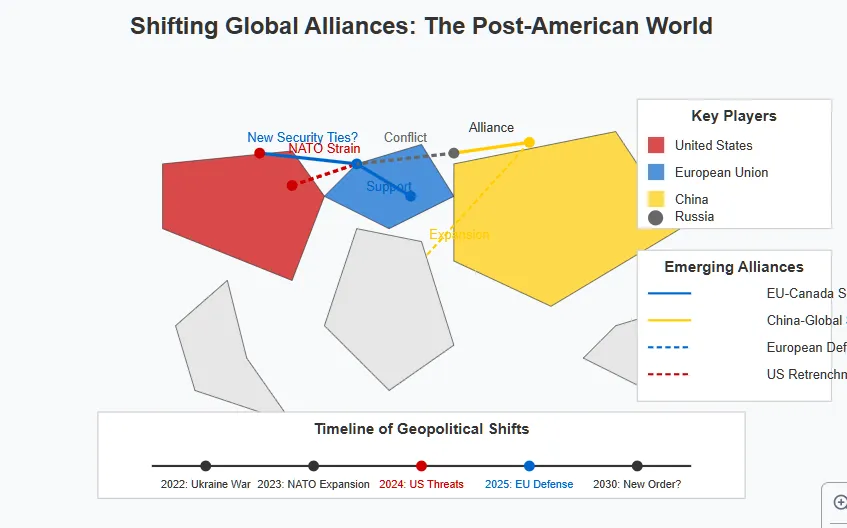

Trump’s NATO threats and annexation rhetoric aren’t isolated incidents. They’re part of a broader shift in global power—one where the United States is no longer the uncontested leader of the Western world. The fallout from this transition is already visible, with Europe accelerating its defense independence, Canada reassessing its alliances, and China and Russia seizing on the chaos.

The U.S. and Canada share the world’s longest undefended border—a symbol of trust that’s now being tested. Even during past trade disputes and political disagreements, full-scale confrontation was unthinkable. Now, that assumption no longer holds.

Key flashpoints in the relationship include:

Canada isn’t alone in this dilemma. If Washington treats allies as expendable, global partners will start hedging their bets elsewhere.

One of the biggest unintended consequences of U.S. retrenchment is Europe’s newfound urgency in building a self-sufficient security architecture. France’s resolution on Ukraine isn’t just about supporting Kyiv—it’s about proving that Europe can lead without Washington.

Possible scenarios in a post-NATO world:

The irony? Trump’s threats may accelerate the very thing he despises: a powerful, self-sufficient Europe.

When a superpower recedes, others move in to fill the gap. The U.S. stepping back from NATO and global leadership isn’t happening in a vacuum—it’s happening at the same time that China and Russia are aggressively expanding their influence.

Three immediate global consequences:

This is the moment where American global leadership unravels—not in one dramatic collapse, but in a series of calculated power shifts that leave Washington increasingly isolated.

The French resolution is more than a policy shift—it’s a symbol of a world adjusting to American decline. If Washington won’t lead, Europe will try. If NATO fractures, alternative alliances will rise. And if Trump’s America is unpredictable, expect global actors—from Beijing to Ottawa—to rewrite the playbook.

The U.S. is no longer the axis around which the world revolves. The question now is: who steps in to fill the void?

The French National Assembly’s resolution marks a seismic shift in global power dynamics. By pushing for the seizure of $400 billion in frozen Russian assets, France is signaling that Europe can no longer afford to wait for American leadership—because that leadership is no longer reliable.

At the same time, the United States is spiraling into unpredictability and retrenchment, with Trump’s threats to abandon NATO and annex Canada shattering long-standing strategic assumptions. These aren’t just words; they’re early warning signs of a world where the U.S. is no longer the central pillar of Western security.

The key takeaways:

This isn’t just about Ukraine. It’s about the future of global order. Will the West adapt to a world where U.S. leadership is unreliable? Or will it collapse under the weight of its own contradictions?

One thing is clear: the post-WWII security framework is dead. What replaces it is still being decided—but the stakes have never been higher.

[…] While the United States drifts deeper into unilateralism under Trump, French President Emmanuel Macr…. His efforts are no longer rhetorical. With U.S. credibility collapsing, Macron is now executing a multiphase strategy to replace American-led security guarantees with European-led strategic autonomy—and he is doing so with growing support from core EU and peripheral NATO states. […]

[…] the same time, Europe is already moving forward with contingency plans for a world where the United States is unrel… Trump’s abandonment of Ukraine and his repeated threats to withdraw from NATO have forced Poland […]