Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

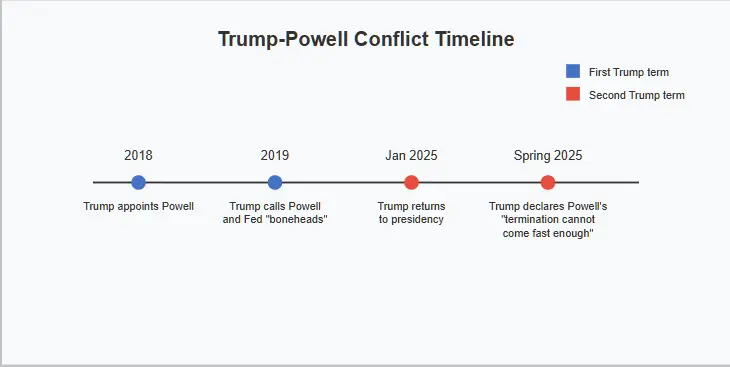

In the spring of 2025, Donald J. Trump — now returned to the presidency with a vengeance — declared that Federal Reserve Chair Jerome Powell’s “termination cannot come fast enough.” The message was delivered with the usual bombast via Truth Social, but the intent was unmistakable. Trump wasn’t just angry about interest rates or inflation numbers. He was signaling open war on one of the last American institutions not yet bent to his will.

Powell, for his part, responded not with technocratic hedging, but with a constitutional stand. When asked if he would resign if Trump demanded it, he replied flatly: “No.” In that single word, the confrontation crystallized. This wasn’t just about monetary policy — it was about whether the machinery of American governance can still say no to the executive branch.

The Federal Reserve was built to operate outside the electoral cycle, buffered from the whims of populism, insulated from the grip of strongmen. Its job is to prevent economic self-destruction, even when that self-destruction is politically convenient. But if Trump succeeds in removing Powell — or even functionally sidelines him through procedural warfare — it would mark the first time in modern U.S. history that a sitting president has forcibly restructured the central bank for political gain.

This article is not a theoretical exercise. It’s a real-time autopsy of institutional fragility in the context of democratic backsliding. It explores what happens when an institution designed to be untouchable suddenly becomes touchable — and what it means when the firewall between monetary discipline and political opportunism starts to crack.

In 2025, the most important man in America might not be the President. It might be the man who tells the President he’s not fired.

The United States Federal Reserve was never supposed to be popular. It was designed to be durable — a bureaucratic fortress that could resist political winds and fiscal fads alike. Established in 1913 by the Federal Reserve Act, the Fed exists precisely because elected officials cannot be trusted to manage money responsibly when reelection is on the line. Its independence is not a flaw. It’s the point.

At the core of this structure sits a seven-member Board of Governors, each appointed for a 14-year term, staggered to prevent any one administration from capturing the institution. The Chair — currently Jerome Powell — serves a renewable four-year term but remains a member of the board for their full 14-year tenure. Powell’s current term as chair ends in May 2026, but his seat on the board extends to January 2028. That’s the safeguard: the Chair can’t simply be fired by a president having a bad week.

Importantly, the law states that a Fed governor may be removed “for cause.” What constitutes “cause” has never been tested — not once in the institution’s 111-year history. No Fed Chair has ever been fired. No president has even tried. That’s not restraint. That’s respect for the nuclear consequences of undermining monetary credibility.

But it’s not just Powell who matters. Vice Chair Philip Jefferson — appointed by Biden and confirmed in 2023 — plays a quiet but pivotal role. In theory, should Powell be ousted or incapacitated, Jefferson would take over as acting Chair. Trump would need to either override Jefferson or sideline him as well. But Jefferson’s institutional credibility and distance from politics could make him a thorn in Trump’s side, particularly if the Fed’s internal vote dynamics turn against any incoming loyalist.

The rest of the Board matters too. Governors Lisa Cook, Adriana Kugler, Christopher Waller, and Michelle Bowman each bring varying degrees of institutionalist, dovish, or independent tendencies. A functional Fed isn’t just one man — it’s a deliberative body. But the Chair sets the tone, controls communication strategy, and serves as the public face of U.S. monetary credibility. If that face is removed by political fiat, the entire façade risks collapse.

The Federal Reserve was built to survive Nixon. To survive Reaganomics. To survive the Tea Party. It was not built to survive a president like Trump who is willing to bulldoze legal precedent simply because he doesn’t like where the interest rates are sitting.

What happens next isn’t just a test of Powell’s courage. It’s a test of whether the Fed, as originally conceived, is still structurally sound in the face of a regime willing to turn everything into a loyalty test.

Donald Trump appointed Jerome Powell in 2018. Within a year, he regretted it.

What began as a straightforward nomination — replacing Janet Yellen with a Republican-aligned technocrat — quickly morphed into an obsession. Trump’s relationship with Powell became a recurring spectacle: tweets berating the Fed for raising rates, public accusations of sabotage, and offhand remarks about wanting to fire him. By 2019, Trump was openly calling Powell and his team “boneheads.” By 2020, amid pandemic panic and zero-bound policy, the rhetoric cooled. But the resentment never died.

Behind Trump’s anger is a worldview: the economy exists to serve the presidency. Powell, with his dry delivery and data-driven caution, represents the opposite — an apolitical technocrat unwilling to juice markets for political gain. That makes him a heretic in Trump’s cosmology.

When Trump returned to power in 2025, inflation had largely stabilized but public anger remained high. Gas prices were up, wages were lagging, and Trump needed a villain. Powell — still in office, still independent, still refusing to cut rates — was the perfect target. And unlike 2019, Trump now had an ecosystem willing to go far beyond angry tweets.

Enter Laura Loomer, Steve Bannon, and the alt-influence class: a constellation of ultra-loyalists pushing Trump to purge the administrative state. In April 2025, Loomer reportedly gave Trump a list of “disloyal” Fed-aligned NSC staffers. Days later, Trump fired NSA Director General Timothy Haugh and multiple national security advisors. Powell, while outside the direct chain of command, loomed over this purge as the ultimate technocrat holdout. The logic was simple: if Trump could decapitate the intelligence community, why not the Fed?

But firing Powell isn’t just personal revenge — it’s policy. Trump has long flirted with extreme economic levers: negative interest rates, tariff-driven stimulus, dollar devaluation, and even gold-backed currency. Powell is a bulwark against all of that. He represents constraints. Rules. Process. Removing him isn’t just about the rates today — it’s about clearing the way for a MAGA monetary theory tomorrow.

If Powell is removed or neutralized, Trump can install a loyalist — someone willing to pump liquidity, cut rates regardless of inflation, and possibly coordinate directly with the White House on fiscal support. That means campaign-season market boosts, election-friendly unemployment numbers, and an economic narrative steered by the executive, not the data.

This isn’t a dispute over 25 basis points. This is a regime attempt to seize control of the most powerful lever in the American economy.

And it’s not theoretical anymore.

Jerome Powell isn’t bluffing. When asked point-blank if he would resign if Trump ordered it, his answer was as flat and unemotional as a Fed press conference: “No.”

That single word placed Powell in the direct path of a constitutional confrontation. Not since Watergate has an American bureaucrat of such institutional weight so openly defied the will of a sitting president. But where Archibald Cox stood between Nixon and impunity, Powell now stands between Trump and the full political capture of monetary policy. If Trump attempts to remove him — and Powell refuses to yield — the question becomes less about legality and more about institutional survival under duress.

What happens next inside the Fed matters just as much. Will Powell’s resolve stiffen the spine of other governors and staffers? Or will it fracture the internal cohesion of the Board of Governors, especially if Trump moves to install a loyalist acting chair or flood the board with allies? In any scenario, Powell’s public refusal makes it far more difficult for Trump to claim consensus. It transforms any attempted removal into an act of aggression, not administration.

There’s also a deeper layer: legacy. Powell knows what this moment means. He’s not just protecting rate targets or inflation models. He’s protecting the very concept of technocratic legitimacy. If he folds, every future Fed Chair becomes a cabinet-level political actor. If he holds, the Fed might survive intact — but he’ll likely do so under immense personal and political pressure.

To some, Powell is an institutionalist to the point of inertia. But in this moment, that caution becomes a weapon. His refusal to resign creates friction — and friction is the only thing preventing the total acceleration of executive control.

And in 2025, “no” is the most radical thing a public official can say.

The short answer is: not clearly, and not cleanly.

The Federal Reserve Act states that a member of the Board of Governors — including the Chair — “may be removed for cause by the President.” But nowhere does the law define what qualifies as cause. Is it criminal behavior? Gross incompetence? Policy disagreement? The ambiguity is deliberate — and it’s never been tested.

Historically, the norm has been restraint. No president, not even during the wild swings of Nixonian paranoia or Reagan-era economic upheaval, has tried to remove a sitting Fed Chair. Why? Because the fallout of crossing that line would be immense. Doing so would signal to markets — and the world — that U.S. monetary policy is no longer guided by independent analysis but by political expedience. Once that precedent is broken, the Fed is no longer a central bank. It’s just another agency under executive control.

But Trump thrives in legal ambiguity. He doesn’t need a court ruling in his favor — he needs a conflict that paralyzes the system long enough to get what he wants. If he declares Powell unfit or accuses him of sabotaging the economy, fires him, and names an acting Chair, he dares Powell to sue. That suit could take months or longer to resolve, during which Trump’s appointee would control the Fed’s operations.

This is the essence of the “de facto removal” strategy: don’t win legally — just change the facts on the ground faster than the courts can respond.

Would the courts stop it? Probably. But that’s not the point. The damage would be done instantly, regardless of eventual judicial review. The perception of Fed independence would shatter. Market actors, foreign governments, and ratings agencies wouldn’t wait for a ruling. They’d act on the signal that America’s central bank had been captured.

There’s another wrinkle: even if Powell wins in court, the fight itself may neuter his effectiveness. A Fed Chair mired in a months-long lawsuit against the White House would struggle to project credibility. Press conferences become political minefields. Every policy move becomes suspect.

And if Trump stacks the Fed with loyalists in the meantime — through expedited confirmations, recess appointments, or acting designations — Powell could find himself outvoted, isolated, and operationally irrelevant even while technically still in office.

This is the legal trapdoor: Powell can’t be fired easily, but he can be sidelined brutally. And if the legal process becomes the battlefield, the institution is already bleeding out on the floor.

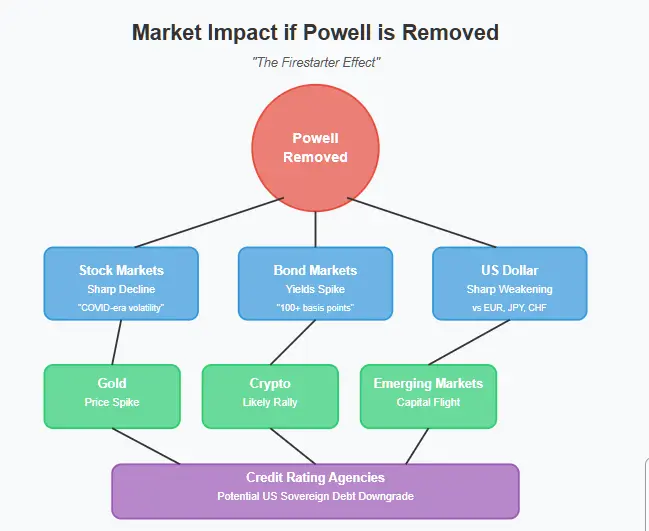

Markets aren’t patient. They don’t wait for legal rulings or political clarifications. They react to signals—and the signal that Jerome Powell has been fired or sidelined by a U.S. president would be interpreted globally as a five-alarm fire.

The immediate response would be a violent repricing of risk. Expect the Dow to plunge, the S&P 500 to drop by thousands of points, and volatility indexes to spike to COVID-era levels within hours. More importantly, bond yields would soar as investors demand higher returns to compensate for the perceived chaos and risk of inflation. The yield on 10-year Treasuries, already sensitive to rate rumors, could spike 100+ basis points in days.

Behind this is not just retail panic — it’s code. Algorithmic trading systems and AI-enhanced hedge funds digest information at machine speed – in a manner analogous to the AI-driven military kill-chain driving a flash war. For these systems, news of Powell’s firing or “forced removal” would be interpreted as a breakdown in central bank independence, triggering automated risk-off cascades across equities, commodities, and currencies.

And the contagion wouldn’t stop in the U.S.

Beyond price action, institutions would react with credibility downgrades:

Even U.S. state treasurers and public pension funds might start rebalancing away from Treasuries. If you’re managing a $100 billion pension fund in California or New York, and you see the Fed implode under presidential pressure, your fiduciary duty kicks in. The selloff spreads. Liquidity evaporates.

This is the Firestarter Effect: Powell’s ouster isn’t just a personnel change. It’s a detonation inside the architecture of global finance.

And here’s the real kicker — even if Powell wins in court, the market damage will already be baked in. Because for financial systems built on trust, perception is reality. And once you show the world that even your central banker serves at the pleasure of the president, you’ve told every investor in the world exactly what kind of country you’ve become.

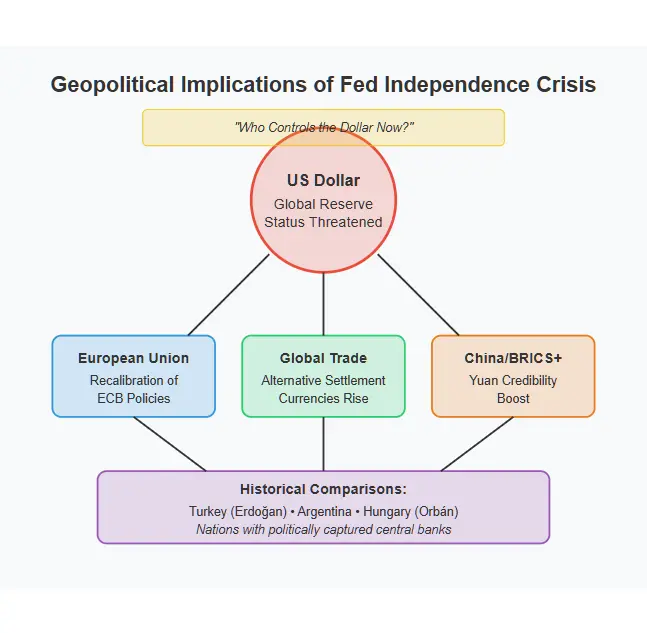

The Federal Reserve isn’t just America’s central bank — it’s the anchor of global economic stability. Its policies set the tempo for capital flows, risk tolerance, and reserve strategies across the entire world. That’s why the idea of its political capture doesn’t just spook markets. It shatters trust in the post-1945 financial order.

In the eyes of global finance, the Fed has always been a symbol of rationality amid chaos. It was the ballast during the 2008 crisis, the conductor of coordinated COVID-era liquidity, and the stabilizer when European banks wobbled. But if Jerome Powell is removed or neutered by executive fiat, that narrative collapses.

The loss isn’t just functional — it’s existential.

Foreign central banks — from the ECB to the Bank of Japan — would immediately begin to recalibrate their assumptions. If the Fed can be politicized, the benchmark for global monetary neutrality no longer exists. That opens the door for decoupling, fragmentation, and a rise in regional currency blocs — something China and the BRICS+ alliance have been pushing toward for years.

The Chinese yuan, long seen as an aspirant to partial reserve status, gets a credibility boost—not because it’s earned it, but because the dollar has just burned some of its own. The BRICS development bank, until now a sideshow, begins to look like a hedge. Gold-backed trade deals and bilateral settlements in local currencies gain traction, not because they’re better, but because they’re safer from political whim.

Even America’s closest allies—the U.K., Germany, Japan—would quietly prepare for a world where the U.S. is no longer the default grown-up in the room. They may not say it out loud, but the recalibration would be immediate. Interest rate decisions in Frankfurt and London would begin to include a new input: How crazy is Washington this quarter?

Historical analogs are bleak. In Turkey, President Erdoğan’s repeated firings of central bank heads triggered runaway inflation and an investor exodus. In Argentina, decades of politicized monetary policy turned the peso into a punchline. In Hungary, central bank subservience made the currency a captive to Viktor Orbán’s whims.

Now imagine that happening to the dollar.

America was never supposed to be an emerging market. But if the Fed falls to political control, it won’t be judged by its Constitution — it will be judged by its credibility. And in the sovereign bond market, credibility is currency.

If Jerome Powell is removed or neutralized by Donald Trump, a fundamental question emerges: Who controls the dollar?

Technically, the U.S. Treasury prints it. The Federal Reserve governs its supply and cost. But confidence—not ink or code—makes the dollar what it is. Confidence that institutions will resist the whims of presidents. Confidence that policy is made by economists, not campaign advisors. Confidence that the United States won’t behave like a petrostate with nukes.

That confidence vanishes the moment it becomes clear that monetary policy is subordinate to presidential loyalty. When Trump installs a loyalist at the Fed—or when Powell is functionally isolated through board-packing or legislative sabotage—the Fed stops being the Fed. It becomes a performative prop in the White House’s reelection script.

And then the dollar becomes… something else.

Not immediately. Not overnight. But slowly, and then all at once.

Major exporters start pricing contracts in euros or yuan. Sovereign wealth funds in Singapore or Norway shift their diversification strategies. Multinationals with USD cash reserves quietly rebalance. The dollar’s “exorbitant privilege”—its power to dictate global finance—starts to decay.

That’s the geopolitical consequence of firing Powell: not a new Fed Chair, but a new era where the dollar is just another currency, and America is just another country that couldn’t leave its central bank alone.

In 2025, control of the dollar isn’t about minting authority or balance sheets.

It’s about whether the people managing it can say no to power.

Jerome Powell may not have signed up to be a political martyr. But in 2025, that’s exactly what he is. Not because he’s grandstanding. Not because he’s looking to fight. But because, in the face of executive pressure and institutional collapse, he said “no.” And that’s enough to turn him into the last man holding the line.

This isn’t about interest rates anymore. It’s not about inflation targets or unemployment numbers. It’s about whether the foundational systems of American governance—checks and balances, institutional independence, rule of law—can survive a Trump presidency that sees every branch as an extension of personal will.

If Powell is fired, and that act goes unchallenged or unresolved, a door is opened that can’t easily be closed. Every future Fed Chair will know they serve at the pleasure of the president, not the Constitution. Every market will price in political volatility where neutrality once reigned. And every adversary of the United States will note, with interest, that even its central bank now bends to power.

But if Powell holds—if he endures the pressure, resists the purge, and preserves the Fed’s autonomy—then America buys itself more than just stability. It buys time. Time to fix what’s broken. Time to remember why some institutions were built to resist even the most popular presidents. Time to remind the world that not everything in America is for sale.

Trump doesn’t need to abolish democracy. He just needs the Fed to flinch.

And if Powell doesn’t?

Then for once, the most powerful man in America might be the one who couldn’t be fired.

[…] the idea that Robinson was a “radical leftist” and suggested the killing was part of an anti‑MAGA conspiracy. These claims provided the context for Kimmel’s on‑air […]