Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

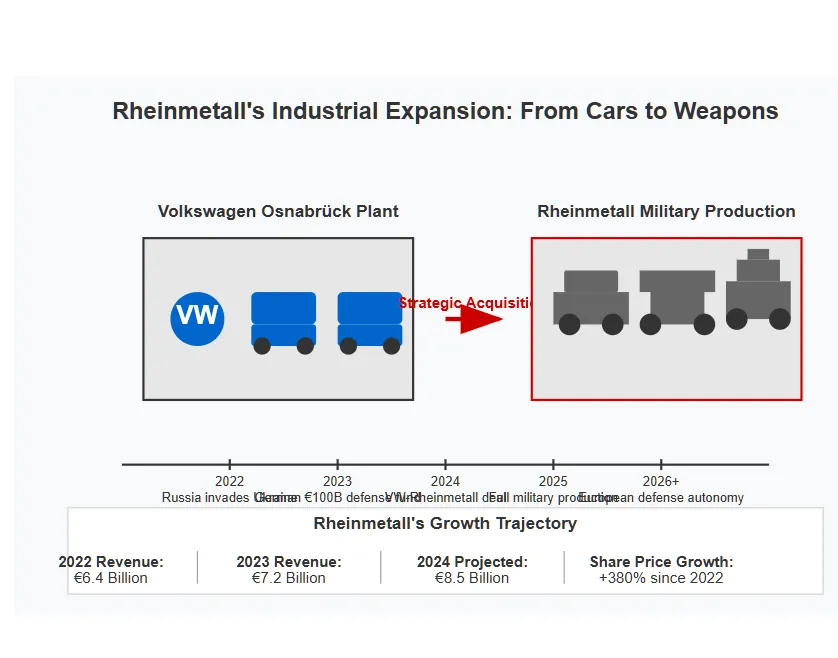

The world is shifting into an era where economic power and military strength are no longer separate domains—they are becoming one and the same. The post-Cold War illusion of global stability has shattered, and in its place, nations are arming themselves for an uncertain future. Nowhere is this more apparent than in Germany, where defense giant Rheinmetall AG is maneuvering to acquire Volkswagen’s Osnabrück factory, converting it from a car manufacturing hub into a war machine assembly line. This is not just an industrial shift—it’s a statement about where the world is headed.

At the same time, NATO, the cornerstone of Western military power for over 70 years, is facing an existential crisis all the while the European continent features several potential flashpoints for war between Russia and NATO. With Donald Trump’s “America First” rhetoric threatening to withdraw U.S. support, European nations are scrambling to rearm, hedge their bets, and rethink their strategic dependencies. Gone are the days of unquestioned American protection—Germany and its European neighbors are realizing that their security is now their responsibility.

And then there’s Canada. Trump’s recent comments floating the idea of annexation—whether political theater or a genuine expansionist impulse—have ignited concerns about the future of U.S.-Canada relations. If America is willing to cast aside NATO, would it hesitate to impose economic or military pressure on its northern neighbor? The question isn’t as absurd as it once was.

The industrial, military, and geopolitical tectonic plates are shifting. What happens next will define the balance of power for the next decade. Welcome to the new era of weaponized economics and strategic realignments.

Germany’s largest defense contractor, Rheinmetall AG, isn’t just expanding its manufacturing footprint—it’s fundamentally altering the way Europe approaches war production. The company’s recent move to acquire Volkswagen’s Osnabrück factory is more than a real estate deal; it’s a blueprint for militarizing Germany’s industrial base in response to geopolitical instability.

Volkswagen Osnabrück GmbH, originally an automobile plant, is an ideal candidate for military repurposing. The facility’s heavy-duty cranes, reinforced load-bearing capacities, and sprawling production lines make it perfect for assembling armored vehicles, tanks, and other defense assets. Instead of rolling out Volkswagens, the factory could soon be churning out Leopard tanks and next-generation military hardware.

This shift isn’t just about Rheinmetall—it’s about the broader transformation of Germany’s industrial strategy. For decades, the country prioritized civilian industry and economic diplomacy over military production. That era is over. Europe’s fears of a declining U.S. security umbrella and an emboldened Russia have forced German policymakers to confront the reality that their future defense won’t be made in Washington—it will be built in German factories.

The push for Rheinmetall’s expansion comes at a pivotal moment. Germany, along with much of Europe, is accelerating defense spending to levels not seen since the Cold War. In 2023, German Chancellor Olaf Scholz pledged to boost military spending beyond the 2% NATO benchmark, reversing decades of defense neglect. Now, defense budgets are surging past 3.5% of GDP in some cases, signaling a long-term investment in military-industrial capabilities.

This is a direct response to two major concerns:

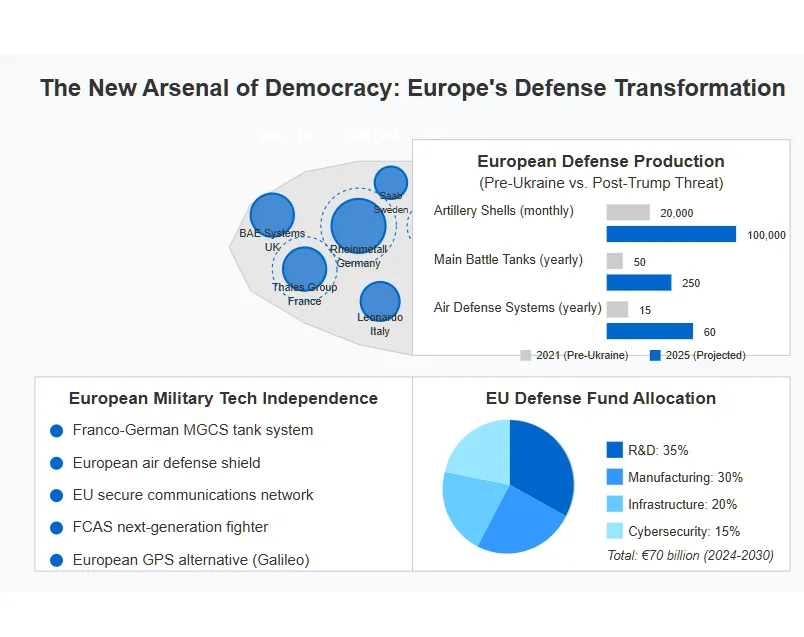

Rheinmetall’s expansion is not an isolated event—it’s part of a larger defense buildup across Europe. Poland is investing billions into new weapons systems, France is ramping up its nuclear deterrent, and even traditionally neutral nations like Sweden and Finland are doubling down on military spending.

Germany, once reluctant to embrace military leadership, is now emerging as Europe’s de facto defense powerhouse. The country has the industrial capacity, the financial muscle, and the political will to turn its manufacturing base into a war production machine.

The Rheinmetall-VW deal is just the beginning. Expect more acquisitions, more repurposed civilian factories, and a growing military-industrial complex across the continent. The days of European dependence on American defense spending are coming to an end. The question is: Will this new militarized Europe be ready in time?

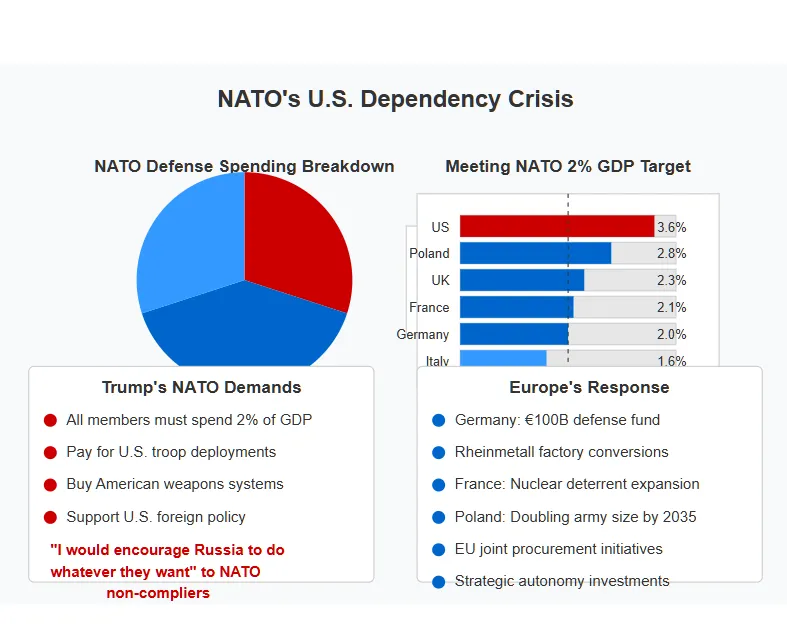

Donald Trump has never been subtle about his disdain for NATO. During his presidency, he repeatedly called the alliance “obsolete” and threatened to withdraw the U.S. unless European countries met their defense spending obligations. Now, as Trump ramps up his 2024 campaign and openly flirts with the idea of a second term, NATO allies are panicking.

At the heart of the crisis is Trump’s pay-for-protection rhetoric—the idea that America’s military guarantees are no longer unconditional. For decades, NATO functioned on the assumption that the U.S. would come to the defense of any member state under attack. Trump, however, has openly suggested that he would let Russia “do whatever they want” to NATO members that don’t meet the 2% GDP defense spending threshold.

This isn’t just campaign bluster. In private discussions, Trump’s advisors have floated scenarios where the U.S. withdraws from NATO entirely or demands a transactional relationship where protection is contingent on direct payments. If Trump follows through, the alliance could collapse overnight.

European leaders aren’t waiting to find out.

For the first time in NATO’s history, European leaders are openly discussing what a post-America NATO would look like. If the U.S. walks away, could Europe sustain a credible defense against Russia?

The numbers aren’t reassuring.

Without U.S. support, Europe would need to rapidly militarize to compensate for the loss of American firepower. This is already happening—Germany has announced a $100 billion rearmament package, France is expanding its nuclear deterrent, and Poland is emerging as a major land power. But these efforts take time, and NATO without America would be a far weaker force in the immediate term.

Europe’s worst-case scenario is already unfolding. If Trump follows through on his threats, NATO’s entire eastern flank—from Estonia to Romania—could be left vulnerable to Russian aggression. Putin has long sought to fracture the alliance, and a U.S. withdrawal would be a dream scenario for Moscow.

Europe’s response? Massive military expansion and new strategic alliances.

The question isn’t whether NATO can survive without the U.S. It’s whether Europe can rearm fast enough to prevent Russia from testing its weakness.

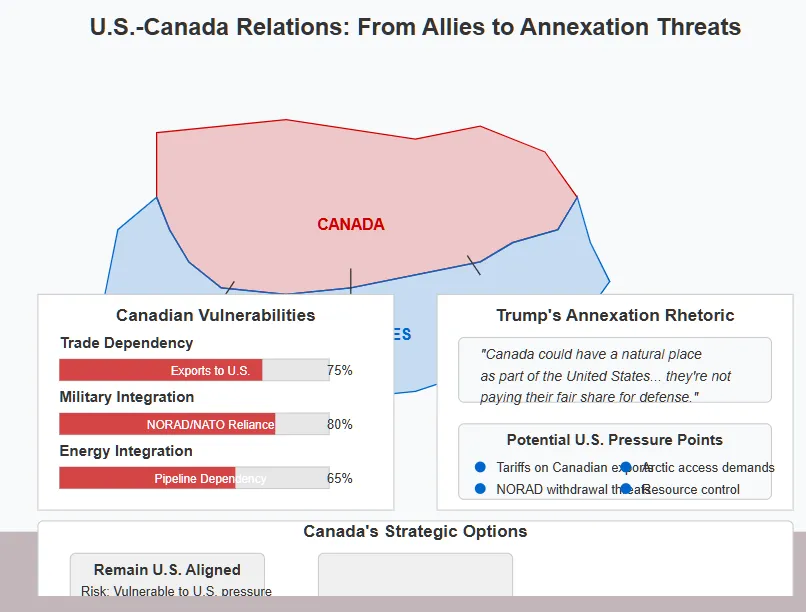

As if NATO abandonment wasn’t enough, Trump has thrown another geopolitical grenade into the mix—the idea that Canada could be “absorbed” into the U.S.

At first glance, this sounds like a joke. But Trump’s history of economic nationalism, territorial ambitions, and protectionist policies suggest otherwise.

Trump’s rhetoric, while largely bluster, reflects a deeper reality: Canada’s economy is heavily reliant on the U.S., and Trump knows it. The U.S. accounts for nearly 75% of Canadian exports, and America controls critical trade routes, energy pipelines, and military alliances that Canada depends on.

Trump’s offhanded comments about Canada becoming the 51st state might have been dismissed as a joke in the past, but his track record of using economic pressure as a weapon makes this a more serious concern than most Canadians want to admit.

This is where Trump’s NATO stance and his Canada rhetoric overlap. If the U.S. is willing to leave Europe out in the cold, why wouldn’t it tighten its grip on Canada instead?

While an outright U.S. invasion of Canada remains a political fantasy, the broader economic and strategic threats are very real.

For Canada, the solution isn’t just diplomacy—it’s deterrence. Trudeau’s government has already pledged to increase defense spending, but whether it will be enough to assert true strategic independence remains to be seen.

The reality is clear: Trump’s America sees Canada not as a partner, but as an economic vassal state. How Canada responds will define its sovereignty in the coming decade.

Rheinmetall’s expansion isn’t just about producing more tanks—it’s about securing Europe’s ability to fight wars without American support. The company’s repurposing of automotive plants is emblematic of a broader shift:

If Trump follows through on his NATO withdrawal threats, the only way the alliance survives is if companies like Rheinmetall step up to fill the void left by American industry.

The problem? Europe’s defense sector is still decades behind the U.S. Rheinmetall’s ambitious expansion will take years to reach full production capacity, and Europe still relies on American defense technology, intelligence, and logistics.

The Osnabrück plant conversion is just one piece of the puzzle. For Europe to replace American military power, it would need:

Rheinmetall is doing what needs to be done—but whether it’s happening fast enough is another question. If NATO loses U.S. support, Europe could be caught in a military no man’s land.

Canada is indirectly linked to this entire rearmament push. If Trump cuts ties with NATO and focuses on using economic leverage to bring Canada to heel, Ottawa will face a critical choice:

Canada’s industrial sector has the potential to become a key defense partner for Europe, especially in aerospace, AI, and raw materials. But for that to happen, Trudeau’s government needs to move now—before Trump turns Canada’s economic vulnerabilities into a bargaining chip.

Europe is building its war machine. Canada is still figuring out if it even needs one. The window to decide is closing fast.

The global balance of power is shifting, and the industrial sector is now on the front lines. Rheinmetall’s repurposing of Volkswagen factories isn’t just about building tanks—it’s about ensuring that Europe can stand on its own militarily. NATO’s survival may depend on whether Germany and its allies can build a self-sufficient war economy before Trump pulls the plug.

Meanwhile, Canada faces its own existential question: Does it stay under U.S. dominance, align with Europe’s defense pivot, or forge its own path? Trump’s annexation threats might be absurd, but the economic and military leverage Washington holds over Canada is very real.

The world is moving toward a new phase of geopolitics—where industrial power is as important as military alliances. If NATO’s European members can’t fill the gap left by a retreating America, and if Canada remains unprepared for a more aggressive U.S., the next decade will belong to those who were ready.

The question isn’t just about weapons. It’s about power, survival, and the future of the global order.

One thing is clear: the nations and companies that prepare for war now will be the ones shaping the peace later.