Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

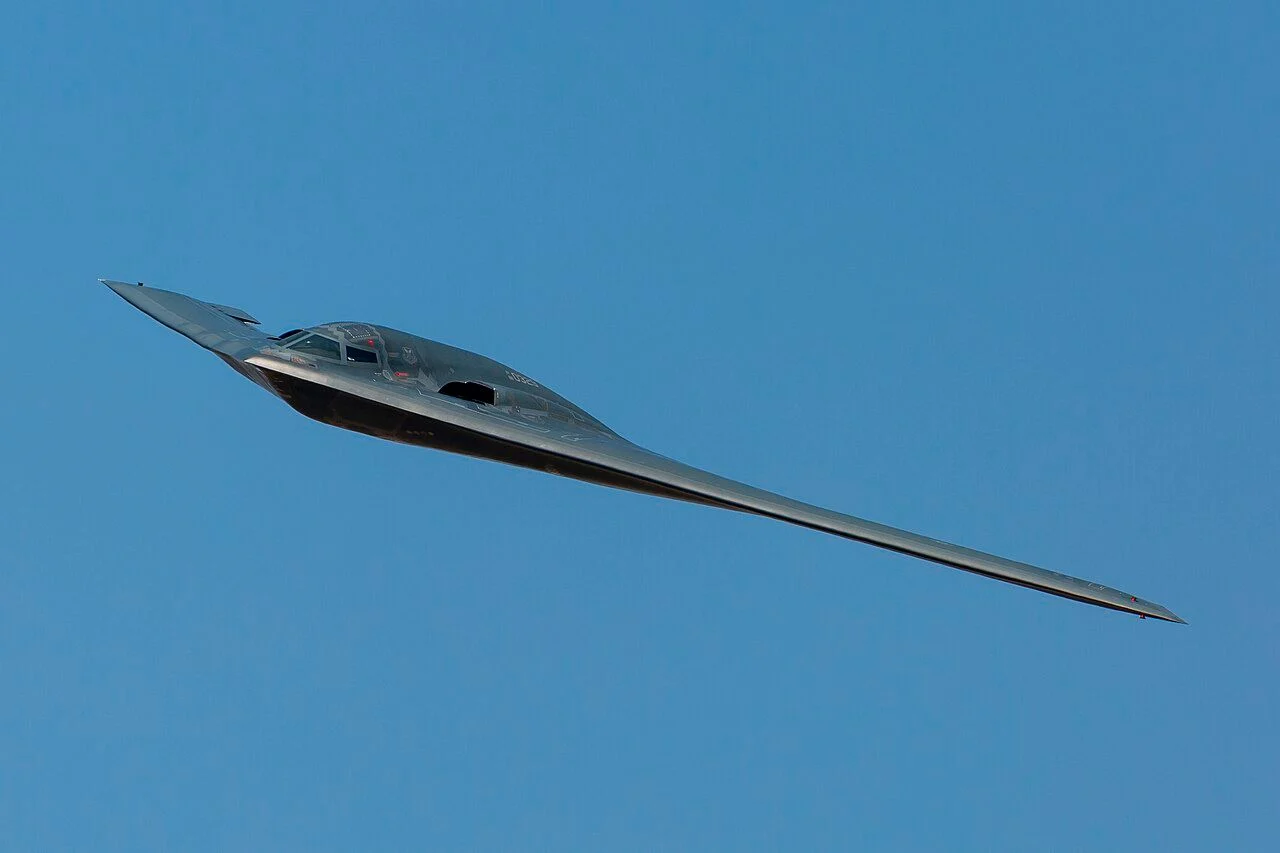

The sudden deployment of seven B-2 Spirit stealth bombers and seven C-17A Globemaster IIIs to Diego Garcia, a remote U.S. military base in the Indian Ocean, marks a major escalation in America’s regional force posture. This is not a drill. With runway closures, MARSA air refueling coordination, and near-continuous bomber departures from Whiteman AFB, the scope of this buildup already surpasses what’s needed for limited strikes against Yemen’s Houthis.

Instead, all indicators suggest something larger is taking shape — a forward-positioned, rapid-response platform aimed squarely at Iran, with the B-2 deployment acting as both a coercive signal and a strike-ready prelude.

While the U.S. continues to frame recent military activity in the region as a response to Houthi attacks on Red Sea shipping, the real strategic calculus runs deeper. Since October 7, 2024, Israel has repeatedly escalated against Iranian targets, launching direct strikes on missile production sites and air defenses inside Iran — with impunity. These strikes, paired with Iran’s rejection of the Trump administration’s February 2025 demand for a new nuclear accord, have shifted the equilibrium.

At the heart of this shift is the Trump-Vance-Hegseth Doctrine: a blunt-force return to hard power, with little interest in multilateralism, strategic ambiguity, or appeasement. The White House’s posture signals that Iran will face direct consequences not only for its nuclear program, but also for its asymmetric activities — including the Houthi naval campaign, Hezbollah operations, and support to Iraqi militias.

This deployment, the most significant at Diego Garcia in over a decade, likely serves a dual purpose: deterring Iranian aggression and preparing for sustained kinetic operations across multiple regional theaters.

This is a pre-war posture, not a symbolic deterrent. The next 30–90 days are critical. Whether the spark comes from a drone strike on a U.S. destroyer, an Israeli miscalculation in Lebanon, or a Houthi hit on a Saudi port, the escalation ladder is already being climbed — and Diego Garcia is the launchpad.

Prime Rogue Inc. assesses with high confidence that the United States is now positioned for war, whether by design or by cascade.

The United States has quietly reactivated one of its most powerful and remote strategic assets — Diego Garcia, a militarized atoll deep in the Indian Ocean. Often overlooked in public discourse, Diego Garcia is a Cold War relic with outsized relevance in 2025: a hardened, sovereign U.S. base leased from the U.K., far from civilian prying eyes and impervious to regional political entanglements. It’s where the U.S. goes when it’s preparing for something serious — something global, or something it doesn’t want anyone to see coming.

Over the last 72 hours, at least seven B-2 Spirit stealth bombers and seven C-17A Globemaster III transport aircraft have either landed at or are en route to the base, according to open-source air traffic data, military communications logs, and visual confirmation from amateur flight trackers. The bombers departed from Whiteman Air Force Base in Missouri — home of the 509th Bomb Wing — under MARSA (Military Assumes Responsibility for Separation of Aircraft) conditions, a procedural rarity used when stealth bombers fly in coordinated strike packages with refueling aircraft.

This isn’t a symbolic flyby. This is strategic saturation.

A newly filed NOTAM (Notice to Airmen) for Diego Garcia shows that Delta Throat to the south ramp — the main taxiway network — is closed through March 27th, indicating preparation for a sustained ground presence and possibly munition loading. In past campaigns — from Operation Enduring Freedom in Afghanistan to pre-invasion Iraq — similar NOTAM and aircraft movement patterns preceded large-scale kinetic action within 30–45 days.

B-2s are not tactical airframes. They’re not used for harassment or messaging. They are strategic deep-penetration stealth bombers capable of delivering both conventional and nuclear payloads. They are designed to fly unimpeded through denied airspace, past advanced radar systems, and destroy critical infrastructure at the outset of a campaign — air defense grids, missile sites, nuclear facilities.

When B-2s are forward-positioned to Diego Garcia, it signals a clear intent to strike targets deep inside hardened territory — and the only target in the region that necessitates this level of penetration is Iran.

Historically, Diego Garcia has been used when the U.S. wants plausible deniability until the moment of impact. It was used in 2001 during the invasion of Afghanistan, again in 2003 for strikes into Iraq, and as a contingency platform during the 2020 Soleimani crisis. What makes the current deployment different is that it lacks the public-facing warning signs — no press conferences, no preemptive diplomatic blitz. Just planes, fuel, bombers, and silence.

The U.S. is forward-loading capabilities, not telegraphing them. In the language of deterrence theory, this is “latent deployment” — the quiet build-up of overwhelming force as both a threat and a ready option. It gives the enemy one last chance to back down — or guarantees that if they don’t, the first strike will be decisive.

In short: Diego Garcia is heating up because war is now a real option — not a bluff, not a leak, not a think tank simulation. It’s happening.

The buildup at Diego Garcia is not just a message to Tehran. It’s a calibrated response to a multi-front escalation campaign, driven by Iran’s network of proxies and sustained through asymmetric warfare. From the Red Sea to Lebanon, from Syria to the Iraqi borderlands, Tehran’s strategy has been consistent: bleed America and its allies through deniable channels, stretch their response timelines, and avoid direct confrontation until it can no longer be avoided.

The U.S. military’s response is currently centered on two overlapping flashpoints: the Houthi insurgency in Yemen, which has disrupted global trade and challenged U.S. naval dominance, and the broader Iranian regional architecture, which uses proxy forces as disposable vassals in a grander strategic chessboard.

Since late 2024, the Houthi movement in Yemen has intensified attacks on commercial and military vessels traversing the Bab al-Mandab Strait, a critical maritime chokepoint linking the Red Sea and Gulf of Aden. In January and February 2025 alone, over 45 vessels were rerouted, and multiple drones, missiles, and loitering munitions were launched at U.S. Navy assets and flagged merchant ships.

In response, the U.S. launched a limited but ongoing aerial strike campaign targeting Houthi missile depots, radar installations, and drone launch sites. While these strikes have inflicted moderate tactical damage, they have failed to restore deterrence. In fact, Houthi messaging has grown more emboldened, with statements directly threatening U.S. bases in Djibouti and Bahrain.

Worse, CENTCOM’s operations have begun to mirror the futility of past counterinsurgency approaches — highly visible, high-tech strikes that degrade capability but not will. The strategic problem is clear: as long as Iran supports and replenishes the Houthis, the threat cannot be neutralized in Yemen alone.

Prime Rogue Assessment:

Iran’s influence doesn’t stop at Yemen. It is the connective tissue binding the region’s chaos together, orchestrating a low-grade war across Iraq, Syria, Lebanon, and the Gulf — often at arm’s length, always with plausible deniability. Its proxy network includes:

This asymmetric architecture allows Iran to exert regional power without crossing the threshold of direct confrontation — until now.

In February 2025, President Trump sent a formal letter to Supreme Leader Ayatollah Ali Khamenei, demanding Iran return to negotiations over its nuclear program within 60 days, under threat of military consequences. Iran responded by burning the letter in a state TV ceremony and conducting live-fire missile drills in Hormozgan Province targeting mock U.S. naval assets.

The regime is not backing down. Why would it? From Tehran’s perspective, the Houthis are bleeding U.S. naval power, Israel is politically isolated, and the Biden-era international coalition is shattered. Iran’s leadership believes the U.S. is reluctant to engage in another major Middle East war — and is daring Washington to prove otherwise.

But Diego Garcia changes that equation.

The deployment of B-2s — with precision capability against deeply buried targets — suggests that Iran’s hardened infrastructure is back on the table: missile silos, air defense systems, and yes, even nuclear facilities. This is not just posturing. It’s a strategic contingency the Iranians have feared for decades.

Prime Rogue Assessment:

The strategic temperature in the Middle East isn’t rising in a vacuum — it’s being intentionally raised by a U.S. administration that no longer views escalation as a risk to be managed, but as a tool to be wielded. The Trump-Vance-Hegseth Doctrine represents a sharp departure from the strategic ambiguity of previous administrations. It’s not reactive, it’s preemptive. It isn’t layered diplomacy backed by force — it’s layered force used to create the diplomatic leverage after the fact.

This administration is post-restraint. It doesn’t care about global consensus or alliance coherence. It is attempting to force a new security order into being — one where American threats are once again taken at face value because they’re backed by visible, terrifying power.

President Donald J. Trump, now in his second term after the most disruptive comeback in American political history, sees his foreign policy legacy as unfinished business. During his first term, he launched the Soleimani strike, withdrew from the JCPOA, and leaned heavily into deterrence-by-chaos. Now, with no electoral constraints ahead of him, he has returned to office with a mandate to go further — and fewer people around him willing or able to say no.

Unlike in 2020, there are no James Mattises or John Boltons tempering the machine. There’s no pretense of coordination with Europe. And perhaps most notably, there’s no patience left for Iran.

In private remarks leaked in February, Trump reportedly told allies that “the only language Khamenei understands is obliteration.” Whether this is bluster or doctrine is increasingly irrelevant — the bomber wings are already in motion.

Vice President J.D. Vance, a once-isolationist populist with a libertarian bent, has quietly repositioned himself in the administration. While his public statements still flirt with non-interventionist language — warning against “forever wars” and “endless bloodshed” — his private influence appears to reflect a belief in surgical dominance: short, intense wars that achieve strategic aims without occupation.

In several public remarks, Vance has emphasized “America’s right to defend its interests wherever they are threatened,” and has notably not pushed back on any element of Hegseth’s expanded rules of engagement.

This isn’t Ron Paul-style isolationism. It’s Andrew Jackson with a drone fleet.

Secretary of Defense Pete Hegseth, a Fox News personality turned Pentagon chief, is perhaps the purest embodiment of this doctrine. Known for rejecting the legacy of counterinsurgency (COIN) doctrine as “elite academic delusion,” Hegseth has reoriented U.S. military planning toward short-duration, high-lethality campaigns with limited follow-through.

In recent war games run by the Office of Net Assessment, prior to its elimination by DOGE, Hegseth’s DOD reportedly prioritized:

The doctrine is simple: hit first, hit hard, don’t rebuild.

There’s no appetite for democratic nation-building. There’s only appetite for decisive action — and clear demonstration that if red lines are crossed, the U.S. will strike without permission, coalition, or cleanup crew.

While the Indo-Pacific continues to occupy long-term strategic thinkers, the Trump-Vance-Hegseth trio has re-centered CENTCOM as the primary theater for American power projection in 2025. The Diego Garcia buildup is a direct reflection of this — a reassertion of American dominance over a region that many believed had been ceded to chaos and proxy drift.

This shift isn’t just rhetorical — it’s logistical. Assets, carriers, tankers, and bombers are moving back into range. The message to Tehran is clear:

The United States is not done with the Middle East. We’re back — and this time, we didn’t bring diplomats.

To the untrained eye, the current deployment to Diego Garcia could be mistaken for a show of force — a calculated bluff designed to pressure Iran into concessions or signal seriousness to regional allies. But for those who understand the logistics, timing, and telemetry of American power projection, the signs are unmistakable: this is not just posturing — this is a pre-war configuration.

It’s not just about what is being deployed. It’s about how, when, and what hasn’t been said.

The deployment of B-2 bombers under MARSA (Military Assumes Responsibility for Separation of Aircraft) protocols is the first alarm bell. MARSA isn’t routine — it’s reserved for complex air operations that involve tight formation flying, often in stealth conditions, alongside tankers and other assets. In this case, multiple B-2s have been flying with KC-135 refueling aircraft, confirmed via Brisbane Center radio callsigns like ABBA11 and BUZZ31.

This isn’t how you fly a PR stunt.

It’s how you fly a combat-ready package — optimized for timing, surprise, and payload delivery. This kind of movement is expensive, high-risk, and typically only undertaken when the operational timeline has already been scoped.

A new NOTAM for Diego Garcia indicated that “Delta Throat to south ramp” was closed from March 25th through the 27th. That may sound benign, but anyone familiar with airbase logistics knows this usually means two things:

During past operations — including the 2003 Iraq invasion and 2011 Libya strikes — similar NOTAM patterns were filed days before bunker-busting sorties and stealth wave launches. The B-2 is a surgical tool, but only when it’s loaded with the right ordnance — and Diego Garcia is one of the few platforms in-theater that can handle earth-penetrating munitions like the GBU-57 MOP (Massive Ordnance Penetrator).

In the last week, open-source flight tracking and satellite data suggest an uptick in Global Hawk ISR flights over the Gulf, Iraq, and Syria. Additionally, SBIRS (Space-Based Infrared System) satellites — typically used to track missile launches and thermal activity — have reoriented coverage patterns in recent days. This implies a pre-strike intelligence sweep, meant to identify:

This kind of ISR surge doesn’t precede speeches. It precedes decisions.

Behind the scenes, there’s growing chatter of digital shaping operations — cyber intrusions and electromagnetic mapping of Iranian infrastructure. Iran’s power grid, communications hubs, and air defense radar arrays have been subjected to increased probing in the last 10 days, according to analysts tracking packet flows and exploit targeting signatures.

In previous conflicts, these cyber operations served two key functions:

If past patterns hold, cyber intrusion surges typically occur within 7–14 days of kinetic action.

Perhaps the most telling sign is the radio silence coming from CENTCOM and the Pentagon. When the U.S. wants to de-escalate, it talks. When it wants to strike, it shuts up. There have been no major briefings, no public warnings, and no Biden-era diplomatic choreography. The White House has gone dark. And in military intelligence circles, silence isn’t peace — it’s the countdown.

Prime Rogue Assessment:

This isn’t a drill. It’s a locked-in kinetic framework, ready to fire if the trigger — political or strategic — is pulled. Whether Tehran sees that and backs down, or calls the bluff, will determine whether Diego Garcia becomes the launching point for the first major state-on-state war of the AI age.

Any discussion of imminent war with Iran that omits Israel is not analysis — it’s fiction. Since October 7, 2024, when Hamas launched its deadliest cross-border assault in decades, Israel has been operating with the ferocity of a cornered state. The psychological aftershock of that attack has permanently altered Israeli military doctrine, creating a doctrine of total preemption, strategic overreach, and a willingness to escalate globally if its national security narrative demands it.

That doctrine now converges, dangerously, with American force projection.

In late 2024 and early 2025, Israel crossed a line that had previously been flirted with but rarely breached: direct kinetic strikes on Iranian military and missile infrastructure inside sovereign Iranian territory. Targets included radar stations, a suspected missile assembly site in Isfahan, and a series of IRGC-linked air defense platforms near Shiraz. These were not cyberattacks or Mossad sabotage — they were air-delivered, visible, and deliberate.

Iran responded with its usual defiance — missile drills, regional threats, and the rhetorical drumbeat of resistance — but it did not retaliate directly against Israel, likely out of concern for triggering a joint Israeli-American retaliation under the Trump administration.

But that patience is wearing thin. And if Iran lashes out — or if Israel preempts again — Diego Garcia’s stealth fleet will not remain idle.

While Trump has publicly criticized Netanyahu’s handling of the October 7 failures — calling his response “slow” and “not strong enough” — the strategic alignment between the two remains intact. Israel continues to act with the assumption that U.S. support is guaranteed, even if Trump himself privately disdains Israeli leadership.

This disconnect creates a dangerous asymmetry: Israel may act thinking the U.S. will follow, while the U.S. may be maneuvering for leverage, not war. In that gap, miscalculation thrives.

Prime Rogue assesses that Israel is the single most likely trigger for full-scale escalation. Key risk vectors include:

Probability Matrix:

Israel isn’t a sideshow — it’s the spark in the powder barrel. The question is no longer if Israel drags the U.S. into war. It’s when, how directly, and how prepared the White House is to own it.

As the U.S. masses stealth bombers in the Indian Ocean and Israel continues its kinetic pressure campaign, the world is not watching passively — it’s repositioning, hedging, and in some cases, quietly preparing for the collapse of the current regional order. The Diego Garcia deployment has triggered a ripple effect across the Middle East and broader Indo-Pacific, with allies, rivals, and swing states all recalibrating in real time.

The Gulf monarchies are stuck in the same strategic trap they’ve occupied since 2011: desperate for American protection but terrified of American escalation. On one hand, they welcome a renewed U.S. presence — especially after Biden’s diplomatic withdrawals. On the other, they know that if Iran is attacked, they are Target #2 after Israel.

UAE port authorities have begun quietly increasing maritime security postures, and Saudi air defense systems have been moved to “Code Yellow” readiness, particularly near Abha and Jeddah.

Prime Rogue Assessment:

Diego Garcia is only 1,800 nautical miles from India’s southern coast. While Delhi remains publicly neutral, Indian intelligence services are closely monitoring American aircraft movements and satellite uplinks — not because they oppose U.S. action, but because they fear regional spillover.

Iran is a major oil supplier and strategic counterweight in the Gulf for India. A U.S.-Iran conflict could jeopardize that balance, draw in China, and push India into a position it doesn’t want: choosing between Tehran and Washington.

Assessment:

China has already begun shadowing U.S. naval movements near the Strait of Malacca and has increased satellite activity over Diego Garcia’s AOI (Area of Interest). The People’s Liberation Army Navy (PLAN) is unlikely to intervene directly — but will use the chaos to test American basing, logistics, and resolve in non-primary theaters.

If war breaks out, expect:

Assessment:

The world isn’t bracing for war. It’s slicing it up into portfolios — calculating how to profit from it, survive it, or stay beneath its shadow.

With the deployment of B-2 bombers to Diego Garcia, Israel on a hair trigger, and Iran flexing its regional proxy network, the situation in the Middle East is balanced on a knife’s edge. What happens next depends on decisions made in backrooms in Washington, Tehran, Tel Aviv, and Beirut — and, perhaps more dangerously, on what happens in the fog of war when those decisions are misunderstood, delayed, or miscommunicated.

Prime Rogue Inc. has modeled four plausible scenarios for the next 30–90 days based on current posture, historical precedent, and real-time OSINT indicators. These futures are not exclusive — the lines between them may blur — but each represents a distinct trajectory with its own risk vectors, outcomes, and strategic implications.

Probability: 25%

Description: The U.S. uses the Diego Garcia deployment as a leverage mechanism without initiating full-scale strikes. Iran, sensing the credibility of the threat, reins in the Houthis and scales down proxy activities. Israel pauses further escalation, either due to U.S. pressure or internal strategic calculus.

Triggers:

Implications:

Probability: 30%

Description: Iran continues to use proxies to attack U.S., Israeli, and Gulf assets, prompting limited U.S. airstrikes in Syria, Iraq, and Yemen. Hezbollah begins probing attacks on northern Israel. Diego Garcia assets remain in reserve, but regional fires multiply.

Triggers:

Implications:

Probability: 35%

Description: Following either an Israeli or Iranian strike on critical infrastructure, the U.S. activates its Diego Garcia-based strike package. B-2s conduct raids on air defenses, missile sites, and nuclear infrastructure. Iran responds with missile attacks on Gulf States, Israel, and possibly U.S. targets in the region.

Triggers:

Implications:

Probability: 10%

Description: A worst-case cascade where U.S., Israel, Iran, Hezbollah, Houthis, and possibly Turkey or Russia become embroiled in a wider conflict. The Red Sea, Eastern Mediterranean, and Gulf become active theaters. NATO cohesion begins to fracture. Pakistan and India are forced to publicly take sides.

Triggers:

Implications:

These futures are not inevitable — but none are unlikely. The coming weeks are not just about what the U.S. can do. They’re about whether anyone still has the will — or the leverage — to stop what’s been set in motion.

For analysts, field operators, and watchers tracking the rapidly escalating situation, the next 7–14 days are critical. Prime Rogue Inc. has compiled the following OSINT indicators and watchlist items that could offer early warning of kinetic action, strategic pivoting, or cyber escalation.

The United States is not bluffing.

The Diego Garcia deployment is not routine posturing, nor is it limited to containment of Houthi aggression. It is the operational architecture of a region-wide war plan, prepared in advance and held on a hair trigger. With stealth bombers forward-deployed, refueling lanes active, ISR platforms sweeping the region, and Israel continuing to provoke escalation, the probability of open conflict with Iran has crossed the threshold of plausibility into inevitability — pending only the triggering event.

The Trump-Vance-Hegseth administration has no interest in long wars, but it is clearly prepared for devastatingly short ones. That calculus — when paired with Iranian miscalculation or Israeli overreach — is a formula for rapid escalation with global consequences.

Strategic Warning: If there is no de-escalation before April 15, 2025, Prime Rogue Inc. assesses with high confidence that military action involving U.S. forces against Iranian targets will commence within the subsequent 30-day window.