Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

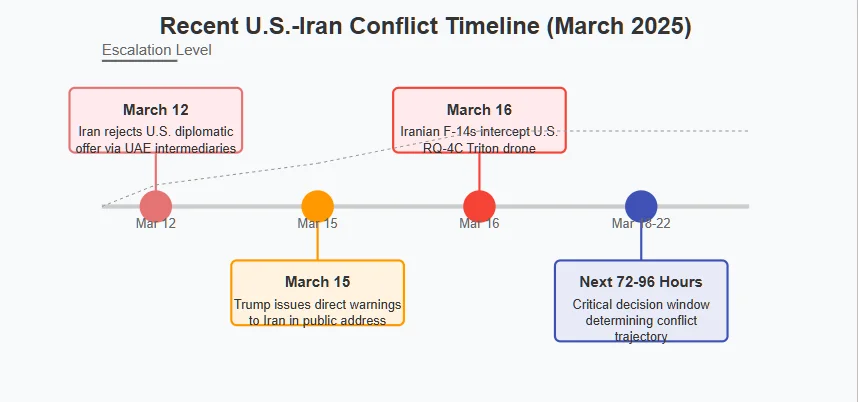

Tensions between the United States and Iran have reached a critical point following a series of military escalations and diplomatic breakdowns. Over the past month, the Trump administration has intensified airstrikes against Iran-backed Houthis in Yemen, issued direct warnings to Tehran, and faced increased Iranian military activity, including the interception of a U.S. surveillance drone near Iranian airspace. With Iran’s leadership rejecting diplomatic overtures and vowing to retaliate against any perceived aggression, the possibility of a broader conflict in the Middle East has significantly increased.

Based on intelligence assessments and military developments, four primary scenarios are projected over the next two weeks (March 16-30, 2025):

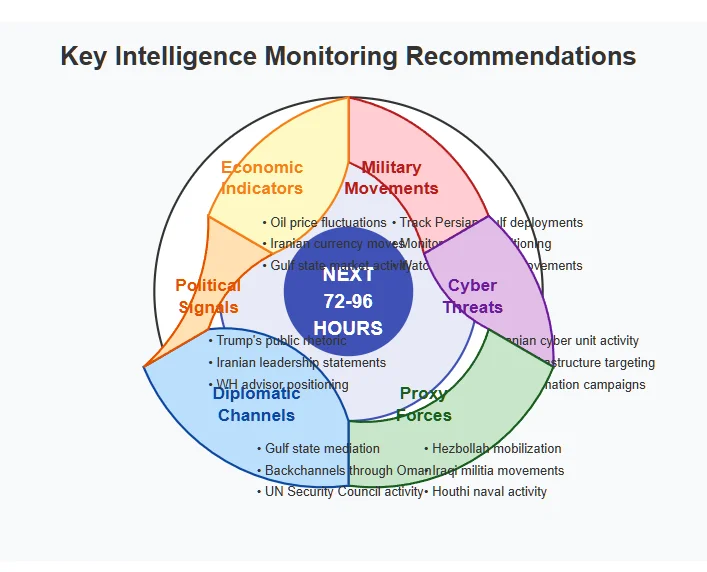

The next 72 to 96 hours will be critical in determining the trajectory of this conflict. Intelligence monitoring will focus on U.S. military deployments, Iranian troop movements, cyberwarfare threats, and potential proxy attacks. While full-scale war is not the most likely outcome, the risk of a miscalculation leading to a major conflict remains a serious concern. If the US attacks the Behshad Iranian spy spy currently in the Red Sea, this would be a potent indicator of imminent conflict

The geopolitical relationship between the United States and Iran has been characterized by decades of hostility, punctuated by periods of indirect conflict, proxy warfare, and failed diplomatic engagements. Since President Donald Trump’s return to office in January 2025, tensions have escalated rapidly, driven by Iran’s continued support for proxy groups, its nuclear program, and a more aggressive U.S. posture in the Middle East.

Key Developments Leading to the Current Crisis

2. Iranian Military Response & Drone Interception

3. Trump’s Direct Warnings to Iran

4. U.S. Military Build-Up in the Region

The next section will outline the probability of each scenario based on available intelligence and historical precedents. U.S. military actions, Iranian countermeasures, and diplomatic shifts will determine whether the crisis escalates or stabilizes.

Based on current intelligence, military activity, and historical precedent, we assess four primary scenarios that could unfold between March 16 and March 30, 2025. Each scenario includes a probability estimate, key triggers, and expected outcomes.

Likelihood: ★★★★☆ (Moderate-High Probability)

✔ U.S. continues airstrikes on Iranian-backed proxies (Houthis in Yemen, IRGC-affiliated groups in Iraq and Syria).

✔ Iran avoids direct escalation, opting for covert retaliation via cyberattacks and proxy forces.

✔ Gulf states (UAE, Saudi Arabia, Oman) pressure Washington to de-escalate.

Assessment:

This is the most likely outcome, as it allows the U.S. to maintain maximum pressure on Iran without committing to direct conflict. Iran, facing economic strain and internal unrest, is unlikely to provoke a direct war.

Likelihood: ★★★☆☆ (Moderate Probability)

✔ Iran directly attacks a U.S. base in Iraq, Syria, or the Gulf region.

✔ Iranian proxies (Kata’ib Hezbollah, Houthis) escalate attacks on U.S. and allied assets.

✔ Trump seeks a show of force ahead of 2024 election season to reinforce foreign policy strength.

Assessment:

A 30% probability suggests this remains a real possibility. The Biden administration’s 2022 Syria airstrikes set a precedent for limited military action against Iranian targets. However, Trump’s past reluctance for full-scale war suggests he may prefer economic and cyber warfare over direct bombing runs.

Likelihood: ★★☆☆☆ (Low Probability)

✔ Iran launches a large-scale missile/drone attack on a U.S. military base or ally (Israel, Saudi Arabia, UAE).

✔ A U.S. naval vessel is attacked in the Persian Gulf (as in the 1988 Operation Praying Mantis).

✔ Iran accelerates its nuclear program, breaching uranium enrichment limits beyond the 90% threshold.

Assessment:

While this scenario is unlikely (15%), the risk of rapid escalation is real. Iran’s nuclear ambitions and its aggressive proxy strategy could push the U.S. toward a decisive military response. However, the Trump administration would likely prefer a “surgical” strike approach over full-scale invasion.

Likelihood: ★☆☆☆☆ (Very Low Probability)

✔ Gulf states (UAE, Oman, Qatar) broker backchannel diplomacy between U.S. and Iran.

✔ Iran temporarily freezes nuclear enrichment in exchange for sanctions relief.

✔ U.S. shifts to covert cyberwarfare tactics instead of military strikes.

Assessment:

Given Iran’s recent rejection of U.S. diplomatic outreach, the probability of de-escalation within two weeks remains low (10%). However, regional stakeholders (Saudi Arabia, UAE) may pressure both sides to avoid conflict.

The next 72 hours will be crucial in determining whether conflict escalates. The situation remains fluid, and intelligence indicators suggest that even a small trigger event could shift the probability matrix rapidly.

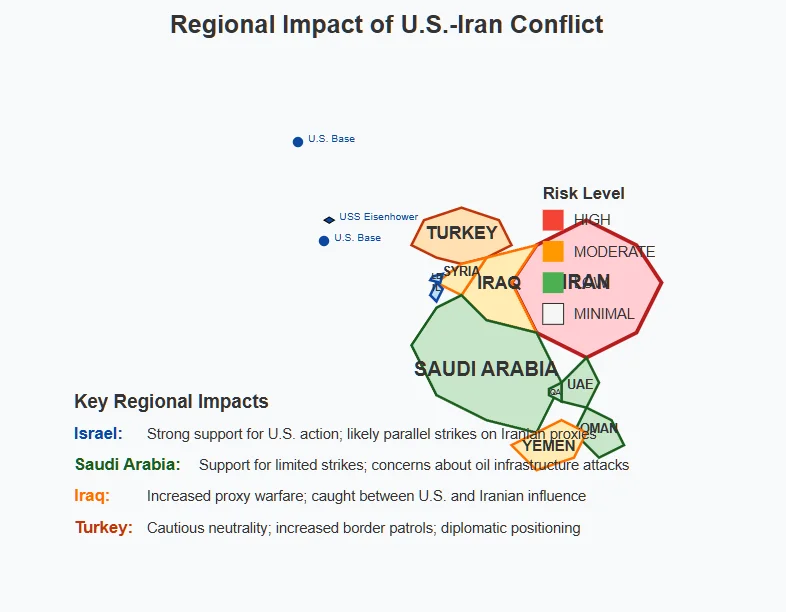

The potential escalation of the U.S.-Iran conflict will have far-reaching consequences beyond the immediate military engagement. A U.S. attack—whether targeted or large-scale—would trigger regional instability, economic disruptions, and diplomatic realignments across the Middle East and beyond.

✔ Israeli Prime Minister Benjamin Netanyahu has long advocated for preemptive strikes on Iran’s nuclear facilities.

✔ If the U.S. strikes Iranian military assets, Israel will likely launch parallel airstrikes on Iranian proxies in Syria, Lebanon, and possibly Iraq.

✔ A major U.S. military operation could prompt Iranian-backed Hezbollah to launch rocket attacks on northern Israel, sparking a secondary conflict.

Risk Level: HIGH – Israel is prepared for escalation and may act unilaterally if necessary.

✔ Saudi Crown Prince Mohammed bin Salman (MBS) is wary of a full-scale U.S.-Iran war but would support targeted U.S. strikes on Iran’s missile sites and military assets.

✔ The UAE and Oman will likely attempt diplomatic mediation to prevent regional economic fallout.

✔ Iran could retaliate by attacking Saudi/UAE oil infrastructure, similar to the 2019 Aramco attack.

Risk Level: MODERATE – Saudi Arabia supports limited U.S. action but fears regional destabilization.

✔ Iranian-backed militias (Kata’ib Hezbollah, Asaib Ahl al-Haq) will increase attacks on U.S. forces stationed in Iraq.

✔ The Baghdad government will struggle to maintain neutrality, facing pressure from both Washington and Tehran.

✔ If the U.S. launches airstrikes inside Iran, Iraqi airspace will likely become a key logistical corridor for U.S. bombers.

Risk Level: HIGH – Iraq will see increased proxy warfare and internal political turmoil.

✔ Turkey will not directly intervene, but it may increase military patrols along its Iraqi border to prevent Iranian-backed militias from destabilizing northern Iraq.

✔ President Erdogan may leverage the crisis to demand greater influence over regional diplomacy and NATO support.

Risk Level: LOW – Turkey will watch carefully but avoid direct involvement.

✔ Any military escalation in the Persian Gulf will immediately spike oil prices, potentially pushing Brent crude above $120 per barrel.

✔ A prolonged conflict could trigger a global recession, impacting energy-dependent economies (China, India, Europe).

✔ The Biden administration and European allies will pressure Trump to de-escalate to prevent economic fallout.

Risk Level: CRITICAL – A U.S.-Iran war would severely disrupt global oil markets.

✔ China will oppose U.S. action but will avoid direct intervention. Instead, it may increase oil imports from Iran to stabilize its economy.

✔ Russia could exploit the crisis by deepening defense ties with Iran, including providing advanced air defense systems (S-400s).

✔ Cyberwarfare activity from both China and Russia is expected to increase against U.S. military and financial institutions.

Risk Level: MODERATE – China and Russia will not intervene militarily but will escalate economic and cyber confrontations.

✔ Trump faces a major decision: Military action could boost his strongman image or risk an unpopular war ahead of the 2024 election cycle.

✔ Republican hawks (Bolton, Cotton) will push for aggressive action, while realists (DeSantis, J.D. Vance) may advise restraint.

✔ Anti-war sentiment in the U.S. remains high, but a limited strike against Iran’s military assets could be politically sellable.

Risk Level: HIGH – The decision will heavily impact Trump’s reelection strategy.

The situation remains highly fluid, and intelligence monitoring must focus on Iran’s military posturing, proxy activity, and Gulf state diplomatic moves.

While current intelligence provides a strong foundation for assessing potential U.S.-Iran conflict scenarios, several critical unknowns could alter the strategic landscape within the next two weeks. These intelligence gaps must be closely monitored to refine threat assessments and adjust tactical planning.

✔ Will Iran directly retaliate against the U.S., or continue using proxy forces?

✔ How much control does Supreme Leader Ali Khamenei maintain over the IRGC’s independent operations?

✔ Could internal political pressure force Iran into an unexpected course of action?

Why It Matters:

✔ Does Trump view Iran as a necessary military target, or is this posturing for deterrence?

✔ How much influence do hawkish advisors (e.g., John Bolton) have on Trump’s Iran policy?

✔ Would Trump use military action to rally political support ahead of the 2024 election?

Why It Matters:

✔ Will Russia provide military aid (e.g., S-400 air defense systems) to Iran?

✔ Will China increase oil purchases from Iran to mitigate economic damage?

✔ How will both nations respond to a U.S. military escalation?

Why It Matters:

✔ Will Iran launch cyberattacks on U.S. critical infrastructure (power grids, financial networks, military systems)?

✔ Could Iranian-backed hackers target U.S. elections or disinformation campaigns to weaken Trump politically?

✔ Are U.S. cyber defenses prepared for a full-scale Iranian digital offensive?

Why It Matters:

✔ Could an unexpected event—like an assassination or hostage crisis—trigger immediate escalation?

✔ Would an Israeli preemptive strike on Iran’s nuclear facilities force Trump’s hand?

✔ Could Iran’s proxies miscalculate and attack a high-profile U.S. target, triggering full-scale retaliation?

Why It Matters:

✔ Monitor IRGC movements for signs of imminent retaliation.

✔ Track diplomatic backchannels to detect any last-minute efforts at de-escalation.

✔ Watch for cyberwarfare indicators, as Iran may choose asymmetric attacks over direct military engagement.

The next 72 hours are critical—any of these intelligence gaps could shift the probability model dramatically, requiring rapid reassessment of conflict scenarios.

Based on current intelligence, military activity, and geopolitical maneuvering, the most likely outcome over the next two weeks is:

✔ Continued U.S. airstrikes on Iranian-backed proxies (45%), particularly in Yemen, Syria, and Iraq, rather than direct attacks on Iran itself.

✔ Moderate risk (30%) of targeted U.S. strikes on Iranian military infrastructure if Iran escalates through direct proxy attacks on U.S. assets.

✔ Low probability (15%) of full-scale U.S. military engagement, as Trump has historically avoided direct war with Iran.

✔ Unlikely (10%) that diplomatic de-escalation will occur, given Iran’s rejection of recent negotiation efforts.

1. Track U.S. and Iranian Military Movements

✔ Monitor air and naval deployments in the Persian Gulf to detect signs of imminent escalation.

✔ Watch for Iranian missile positioning near key U.S., Israeli, and Saudi targets.

✔ Observe any movement of U.S. bombers (B-52s, F-35s) toward Middle Eastern bases, signaling potential airstrikes.

2. Assess Cyberwarfare & Asymmetric Threats

✔ Iran’s cyber units may attempt retaliation instead of direct military engagement.

✔ Monitor attacks on U.S. financial institutions, government systems, and power grids.

✔ Expect pro-Iranian disinformation campaigns in global media.

3. Evaluate Proxy Retaliation Risks

✔ Increased rocket/missile attacks by Hezbollah or Iraqi militias could trigger a wider escalation.

✔ Iran may activate Houthi forces for further attacks on Red Sea shipping routes.

4. Political Considerations & Diplomatic Channels

✔ Monitor Gulf State mediation efforts, as Saudi/UAE leaders may try to prevent escalation.

✔ Watch for shifts in Trump’s rhetoric, which could indicate last-minute changes in strategy.

The next 72 to 96 hours will be critical in shaping whether this remains a proxy conflict or escalates into a full-scale U.S.-Iran confrontation. While a direct U.S. attack on Iran is not inevitable, the risk of miscalculation remains dangerously high.

[…] While the White House maintains that the deployment is defensive, the presence of three carrier grou… Whether this remains a show of force or escalates into a larger military conflict will depend on how Iran, the U.S., and other regional actors navigate the coming weeks. […]