Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

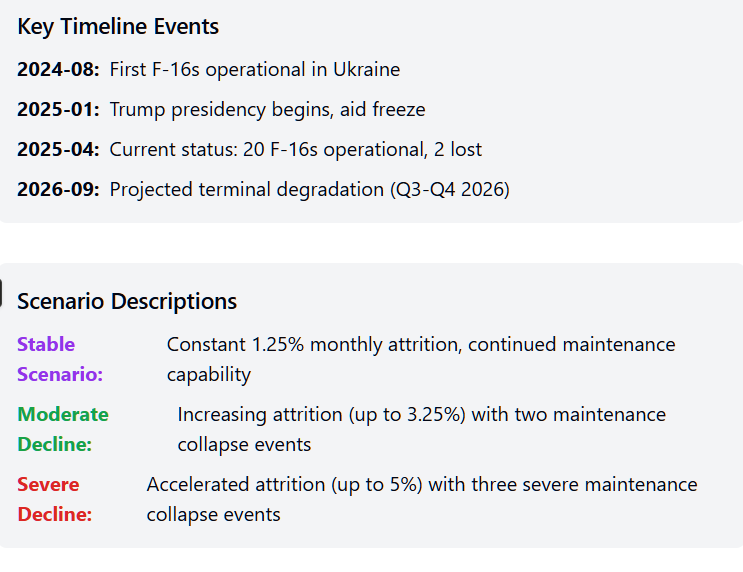

On April 12, 2025, Captain Pavlo Ivanov, a 26-year-old Ukrainian Air Force pilot, was killed while flying a U.S.-donated F-16 on a combat mission. He was the second confirmed Ukrainian F-16 pilot to die in combat since the aircraft were deployed in August 2024.

His death was not just a tragedy—it was a strategic signal.

Ukraine’s F-16 fleet is small, elite, and symbolically powerful. But it is also unsustainable. With approximately 20 aircraft operational, Ukraine has already lost 10% of its modern fighter fleet in under eight months. These jets were designed to operate inside the NATO battle architecture—supported by ISR, real-time targeting, and deep maintenance networks. Ukraine has only fragments of that structure. Every airframe destroyed is gone forever unless replaced by the West. Every pilot killed is the loss of a NATO-trained operator Ukraine cannot afford to lose.

Now, with the second Trump administration in full swing, the United States has suspended key military aid to Ukraine. Deliveries are stalled. Training pipelines are freezing. And the strategic umbrella that once sustained Ukraine’s air war is fraying.

Europe is responding—with large-scale procurement plans, joint debt proposals, and promises of strategic autonomy by 2030. But these are long-term moves, not stopgap solutions. No European actor—not even France or Germany—can match the breadth, speed, and strategic depth of American military support in the air domain.

This brief argues that Ukraine’s air war is entering terminal decline. Tactical victories will continue. But absent immediate intervention—either by a U.S. policy reversal or an unprecedented escalation in European logistics—Ukraine’s fighter fleet will degrade to irrelevance by mid-to-late 2026, and NATO’s credibility may follow it into the ground.

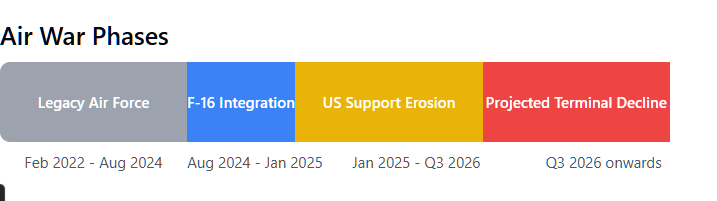

Ukraine’s fighter fleet has undergone a transformation since Russia’s full-scale invasion in February 2022, evolving from a degraded post-Soviet air force to a high-performance patchwork of Western platforms. This evolution, however, has come at the cost of strategic autonomy.

At the outset of the war, Ukraine operated a fleet of Soviet-designed MiG-29s, Su-27s, Su-25s, and Su-24s—aging platforms that were heavily attrited during the initial stages of Russian air and missile bombardments. By late 2023, more than half of Ukraine’s legacy fighter inventory had been destroyed, rendering the country’s capacity to contest airspace largely symbolic. Stopgap deliveries of French Mirage 2000s and limited Polish MiG airframes extended operational capability, but could not shift the strategic balance.

In August 2024, Ukraine received its first operational U.S.-donated F-16s, with pilot training completed in the Netherlands, Denmark, and the United States. As of April 2025, approximately 20 F-16s are confirmed to be in Ukrainian hands, with over 100 pledged through multinational commitments from the Netherlands, Norway, Denmark, Belgium, and Greece.

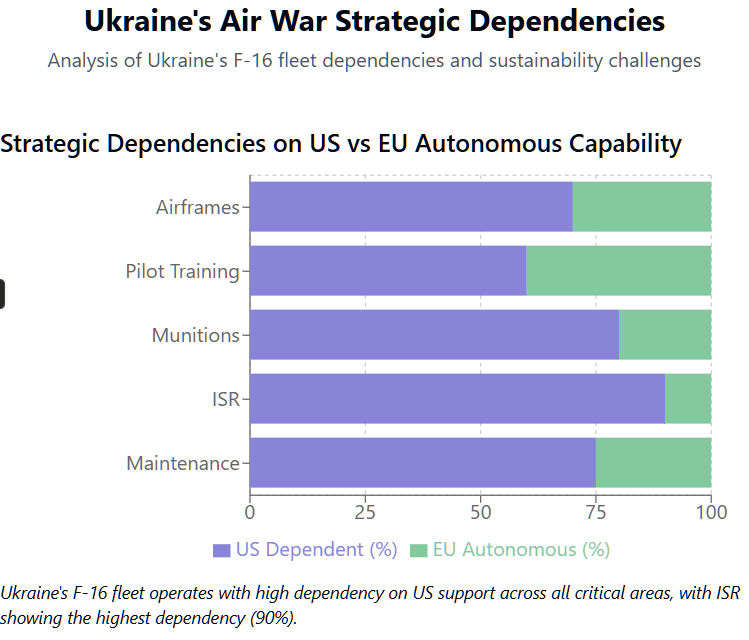

But these airframes do not exist in a vacuum. The F-16 is a deeply networked aircraft designed to function as part of NATO’s real-time intelligence, surveillance, targeting, and maintenance ecosystem. Without full access to this architecture, Ukraine’s F-16s operate under degraded conditions—both blind and outnumbered.

The result is a tactically capable force flying in strategic dependence. Every mission relies on imported aircraft, foreign-trained pilots, external ISR feeds, and U.S. or NATO-supplied munitions. It is an air force that can fight, but cannot survive alone.

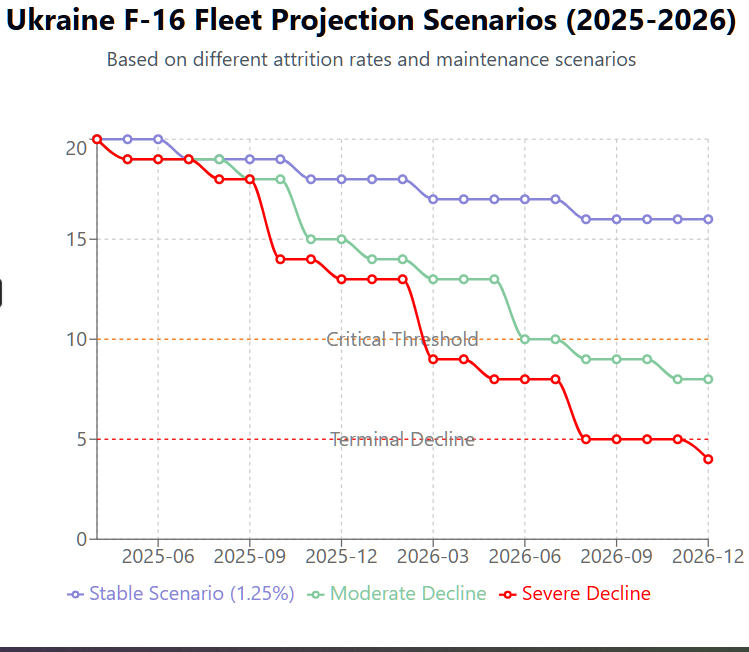

Since Ukraine began operating F-16s in August 2024, its loss rate has remained alarmingly high relative to fleet size, though still lower than its attrition rate during the early war period with Soviet-era jets. As of April 2025, Ukraine has lost two confirmed F-16s, amounting to a 10% degradation of its most advanced fighter capability in less than eight months. This translates to an approximate monthly attrition rate of 1.25%.

By comparison, Ukraine’s legacy fighter fleet suffered 46–55% losses between February 2022 and August 2023. These losses, though numerically higher, were absorbed by platforms already reaching obsolescence and were later partially backfilled by transfers from NATO’s eastern flank. That option no longer exists.

The real asymmetry, however, is not in the raw numbers—but in the consequences of each loss.

Each F-16 represents not just a multirole jet, but a strategic investment ecosystem:

Unlike Russia, which has sustained 20–25% overall losses across its fixed- and rotary-wing inventory but continues regenerating from domestic production, Ukraine has zero internal replenishment capacity. Every downed aircraft or lost pilot is an unrecoverable strategic loss, not just a tactical setback.

Even if Ukraine outperforms Russia in kill ratios or mission efficiency, its inability to replace what it loses transforms attrition from a statistic into a countdown. Without rapid and uninterrupted foreign resupply, Ukraine’s air superiority denial strategy becomes self-limiting—and eventually self-defeating.

Ukraine’s fighter fleet has drawn global admiration for its tactical resilience, but behind that resilience lies a dangerous structural blind spot: the absence of strategic air power and indigenous intelligence-surveillance-reconnaissance (ISR) autonomy.

While Ukraine has adapted creatively with UAVs, commercial satellite data, and Western intelligence support, it lacks any indigenous ability to perform long-range target acquisition, threat tracking, or real-time electronic battlespace coordination. These functions are critical in modern air warfare, especially for a platform like the F-16, which was designed to operate as part of a full-spectrum Western battle network.

By contrast, Russia’s strategic air capabilities remain largely untouched. Despite two high-profile shootdowns of A-50 AWACS aircraft and the loss of a Tu-22M3, the bulk of Russia’s strategic aviation remains fully operational:

Ukraine, by contrast, has no AWACS, no long-range bombers, no manned ISR aircraft, and no domestic satellite infrastructure. Its ISR picture is reactive, fragmented, and heavily reliant on Western allies to fill in the gaps—with delays that are measured in minutes or hours, not seconds.

This asymmetry is the omitted variable in most Western assessments of air power parity. Ukraine may have gained F-16s, but it did not gain the surrounding digital nervous system that makes those jets dominant in NATO operations. Without that ISR backbone, Ukraine’s advanced fighters operate as blunt instruments in a precision-dominated battlespace.

As a result, Ukraine’s air war is not just attritional—it’s partially blind. And in the modern era, air forces don’t just lose to missiles—they lose to lag.

In the wake of U.S. strategic retrenchment under President Trump’s second term, Europe has scrambled to mount a meaningful response. While the intent is serious and the financial scale impressive, the operational reality remains unchanged: Europe cannot close the gap in time—not for Ukraine’s fighter fleet, and not for the integrated architecture it depends on.

The European Union has proposed Readiness 2030, a bold €800 billion defense initiative focused on joint procurement, ISR development, and industrial rearmament. Plans are also advancing for a European Defence Mechanism (EDM)—an intergovernmental fund to jointly acquire and manage strategic weapons. The European Peace Facility (EPF) continues to disburse funds, and the Weimar+ group—France, Germany, Poland, Italy, Spain, and the European Commission—has vowed to lead European rearmament.

But this is long-cycle procurement—not a wartime pipeline.

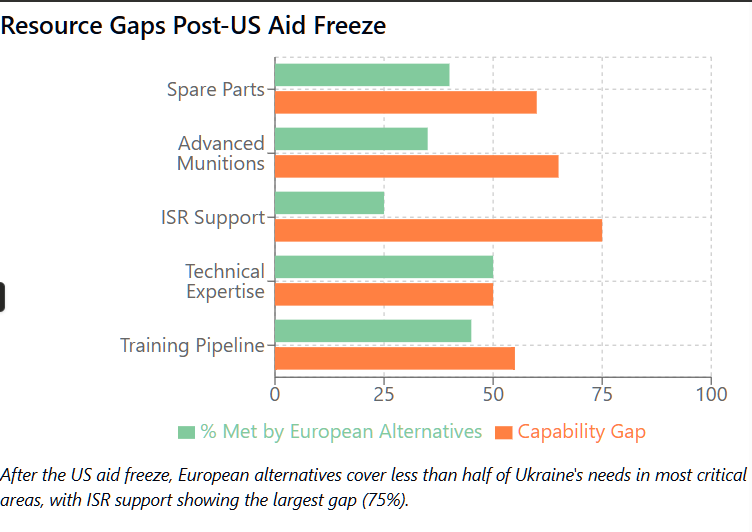

As of April 2025:

Most critically, no European actor offers the full-spectrum package Ukraine needs: aircraft, munitions, ISR, trained pilots, and logistics. The United States was the only country capable of delivering all five simultaneously. That system is now frozen.

Europe is buying time, not replacing capability. Its moves are real, and they may prevent collapse. But they cannot stop degradation. Without U.S. recommitment—or an unprecedented European escalation—Ukraine’s air force will remain in flight only until the math no longer allows it.

The re-election of Donald Trump in November 2024 marked a geopolitical rupture. Within weeks of assuming office, Trump ordered a temporary freeze on all lethal aid to Ukraine, halted F-16 deliveries pending “cost-sharing negotiations,” and openly questioned whether further support should be extended without tangible Ukrainian “returns”—a transactional foreign policy approach that reduces defense to debt collection.

This policy shift gutted the continuity that had underpinned Ukraine’s air war. Pilots midway through NATO flight training were left in limbo. Munitions packages stalled. ISR data access became restricted. Perhaps most damaging, the message was unambiguous: Ukraine could no longer count on the U.S. as a strategic guarantor.

This isn’t just a funding issue—it’s a doctrinal failure. The F-16 is a system-dependent aircraft. Without the U.S. providing replacement parts, logistics nodes, electronic warfare integration, or high-grade munitions, these jets become less effective with every sortie. And there is no slack in Ukraine’s system. Every airframe is operational. Every pilot is on rotation. Losses now represent not depletion—but collapse in slow motion.

Based on current resupply schedules, munitions usage rates, and known loss trends, Ukraine’s F-16 fleet enters terminal operational degradation by Q3–Q4 2026—regardless of pilot morale or tactical success. If Trump’s policy remains unchanged, this degradation becomes irreversible.

What Ukraine faces is not a crisis. It is a countdown. And when the final aircraft is grounded—not by a missile, but by lack of parts—the war may still be winnable. But the air will belong to Russia.

Ukraine’s fighter pilots are not just competent—they are exceptional. Trained in Denmark, Arizona, and Romania, many are flying combat sorties in F-16s with fewer than 200 hours in type. Yet they are executing high-risk missions daily: strike escorts, SAM suppression, UAV interceptions, and deep interdiction runs under contested airspace. By NATO standards, these are missions typically reserved for far more experienced crews operating within layered ISR and EW support networks.

And they are succeeding. Ukrainian pilots are logging successful engagements against cruise missiles and loitering munitions with minimal aircraft losses. They are flying in degraded airframes, in weather, under radar suppression, and surviving.

But brilliance is not a substitute for structure.

Behind each success lies a brittle chain of dependency:

Even with superior pilots and exceptional morale, Ukraine’s air force is still subject to hardware exhaustion and logistics entropy. The only reason it continues to operate is because it has not yet crossed the attritional threshold where parts, fuel, and pilot availability drop below minimum viable combat capability.

That threshold is now visible on the horizon.

In any other NATO air force, what Ukraine is doing would be called a miracle. In Ukraine, it’s the only option left. And that reality is not sustainable—it’s tragic.

The degradation of Ukraine’s fighter fleet is not happening in a vacuum—it is being watched closely by every U.S. ally, every NATO partner, and every adversary looking for an opening.

For frontline NATO states like Poland, Estonia, Latvia, and Lithuania, the suspension of U.S. military aid has reopened a fundamental question: Is NATO’s eastern flank defensible, or is it conditional on the whims of American politics? The Biden-era model of collective deterrence has been replaced by Trump’s transactional doctrine, and Ukraine is the test case.

If Ukraine’s F-16 fleet fails—not because of Russian battlefield supremacy, but because the West lets it wither on the runway—it will signal to allies that the credibility of Western security guarantees is discretionary. That signal will travel fast.

Russia is already acting accordingly. It has intensified missile strikes, probing NATO’s deterrence posture along the Black Sea and the Suwałki Gap. It has escalated gray-zone operations in Moldova and Transnistria, and increased its strategic bomber sorties from Murmansk to Kaliningrad.

Meanwhile, in the Global South, where Western influence is already eroding, Ukraine’s air campaign has become a proxy for Western commitment and resilience. A visible collapse of the fighter fleet would not just damage Ukraine’s warfighting capacity—it would fracture the strategic mythology that sustains Western alliance systems.

The jet doesn’t have to crash for NATO to lose credibility.

It just has to be seen drifting downward—and unanswered.

Ukraine’s fighter fleet is still operational. Its pilots are still flying. Its missions are still being executed with precision, discipline, and sacrifice. But absent a strategic course correction, the trajectory is clear: this is an air war on borrowed time.

The current rate of attrition, combined with frozen aid deliveries and absent ISR infrastructure, creates a predictable curve of degradation. By Q3–Q4 of 2026, the F-16 fleet—now Ukraine’s most capable air power platform—will no longer be viable as a force multiplier. Missions will be limited. Airframes will be cannibalized. Pilots will be grounded not by Russian missiles, but by missing parts and fuel. Strategic air denial will collapse, followed swiftly by a qualitative shift in Russian operational freedom.

Europe’s stepped-up efforts are real, but insufficient. Even if funding is secured and procurement plans executed, the timeline does not match the urgency. Europe can slow the bleeding. It cannot stop the collapse—not without immediate U.S. reengagement.

Ukraine has not lost the air war. But it will—unless its allies choose not just to admire its resilience, but to reinforce it.